Banking as a service (BaaS) is a red-hot way for non-banking brands to offer financial services without investing in building out the costly infrastructure of an actual bank. Virtually any brand or business—technology firms, retailers, even rideshare companies—can partner with a traditional bank to provide loans, money movement, bank accounts, and other financial products to their clients and customers.

To start, what are the benefits of BaaS for a brand?

Brands sign on with a banking partner to serve as the financial backbone of a money-focused product like investing or mobile banking tools. In many instances, brands use BaaS to overcome a stubborn customer objection and remove obstacles from the sale-closing process.

Think of the early start of the credit card. Large department stores were thinking of ways to encourage shoppers to spend more money. Even with the right product mix, on-point advertising, and convenient parking, there’s one practical barrier to how much a customer can buy: how much money they have in their pocket.

How did department stores overcome this objection? By offering the first buy-now-pay-later system in the early 1900s. By presenting a unique token at checkout, customers could defer payments until the end of the month. How much they could buy was no longer limited by the depths of their pocketbook.

The problem? With the added job came the taxing reality of chasing down payments at term’s end and floating the business until customers could pay their bill. In 1958, J.C. Penney became one of the first retailers to offer their own proprietary plastic by partnering with a bank to handle the financial side of the transaction. The retailer would get more customers by offering flexible payment options on large purchases, while the bank would handle the heavy lifting of regulatory compliance, financing, and holding balance sheets.

From the user perspective, they’re a customer of the front-facing brand. But invisibly behind-the-scenes, a banking partner like Green Dot, Goldman Sachs, or Bancorp handles the money. Fast forward to now, and it’s not just department stores reaping the benefits of the BaaS system.

By paying for access to a traditional bank’s financial infrastructure using APIs, tech brands can expand their customer base, flatten speed bumps slowing the customer journey, or offer niche features mass-marketed banks cannot support. How are the most innovative brands leveraging BaaS to serve as the foundation of their ever-growing suite of financial products?

1. Varo

While Varo was the first Fintech to become a bank in July 2020, they started by embedding Bancorp services to power their all-mobile banking platform. Their target market? The one in five Americans that have never established a credit profile. Varo welcomed “credit invisible” customers with open arms, those who traditional models had aggressively turned away.

Barriers like credit checks and exorbitant fees became a thing of the past with neobanks like Varo. This online bank offers the same—if not more—functionalities for customers typically left out of the banking picture, and the perks are very appealing. Customers can improve their credit, grow their money, learn about finances, get paid earlier, and round-up charges into investment accounts.

2. Wealthfront

Financial technology firms have led the charge in unleashing powerful investment opportunities typically locked behind closed doors for wealthy customers. Rolling out the red carpet to a financially secure future is Wealthfront, a cash management service borrowing the financial infrastructure of a variety of banking partners like GreenDot.

Andy Rachleff, co-founder of Wealthfront, found that the average brick-and-mortar bank location costs the average customer $200 per year. Tech-savvy Millennials and the 80% of customers hesitant to visit a physical branch end up footing the high bill for expensive infrastructure they never step foot in.

Instead, Wealthfront focuses on the features upwardly mobile young professionals actually use. Direct deposit with Wealthfront platform, and they will automatically pay your bills and robo-route the remaining money to the most valuable investment account depending on your unique goals. They’ll rank the priority of each of your debts and automatically determine how much to pay to each. They also offer up benefits like tax loss harvesting and investment strategies most banks reserve for their most high-paying clients.

3. Chime

Farewell brick-and-mortar: mobile-only banks like Chime continue to scoop up customers disenchanted by traditional banking models. Through a partnership with Bancorp and Stride Bank, cashless cohorts can enjoy benefits typically reserved for checking account holders. With a $14.5 billion valuation, Chime leapfrogged from a debit prepaid card service to a full-on suite of financial services appealing to Americans excluded by the Big Four in banking.

This branchless bank offers benefits like two-day-early paycheck availability and account structures that help financially disenfranchised customers build credit. Chime focuses on building a best-of-the-best mobile app, while its banking partners handle the financial legwork in the background.

4. Uber

Uber aspired to not just be a source of income for its army of rideshare drivers, but to become a partner in their success. In a BaaS partnership with Barclays and Green Dot, Uber provides tools for drivers to deposit, track, manage, move, and money.

Uber also leverages banking financial services to overcome many barriers to entry. Don’t have access to a car? Uber and other rideshare programs can help you rent a vehicle so you can hit the road within a few days. These tools not only help drivers take charge of their financial future, but build an ecosystem of “sticky services” that secures the relationship over the long haul.

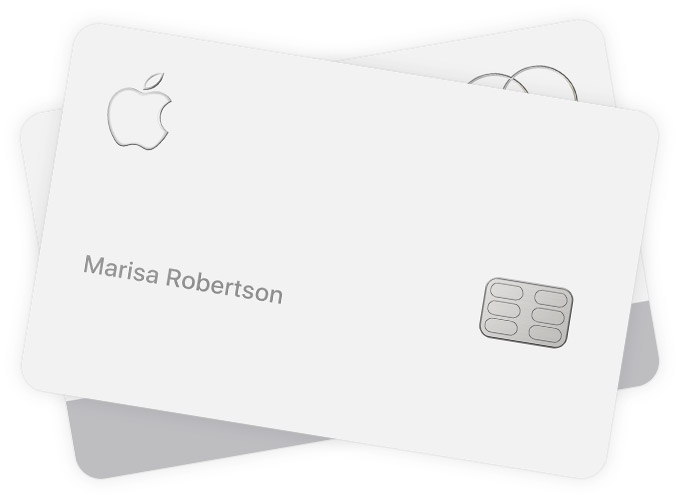

5. Apple Card

Similar to Uber, Apple leverages BaaS opportunities to further ingratiate its customers into the Apple ecosystem. Gone are the days of a bulky billfold overflowing with receipts and old business cards—the wallet is digitizing and Apple wants to ensure that its flagship iPhone and Apple Watch devices are leading the sea change.

Apple partners with Goldman Sachs to further bond tech-savvy generations with their beloved smart device. Apple Card not only serves as a retail-facing credit card, but powers-up the Wallet App with bill payment features and tools to help customers establish healthy spending habits. Plus, Apple infuses their card experience with tons of other iPhone features that diehards love: they’ll pinpoint on Maps the specific location of a retailer, and allow you to approve online payments with a quick scan of your face.

Banking as a Service helps technology brands focus on what they do best—provide a stellar, innovative customer experience. They can focus on designing a chart-topping, feature-rich mobile app, while an established bank handles the financial heavy lifting.