Between new governing laws, increased security threats due to fraud, and increasing pressure from consumers for better customer experience, traditional banking practices have quickly become outdated.

To meet these challenges, banks have been turning to digital transformation to retain their competitive edge on all fronts, with early adopters seeing the greatest reward. Analysts and experts estimate that AI will save the banking industry roughly $1 trillion by 2030.

According to Narrative Science, 32% of the participating banks in their 2018 report are already incorporating predictive analytics, recommendation engines, voice recognition, and response times in their processes. The greatest reasons more banks aren’t on board yet? Cost, the talent gap, and legacy systems continue to top the list. Banks with more than $100 billion in assets are 75% more likely to already be using AI, compared to 34% for those with less than $100 billion in assets.

Despite the cost, the world’s biggest banks are delivering new ways to attract and retain customers, improve their processes, and save money in ways never seen before. Read on to discover five ways AI is revolutionizing the banking industry.

Ways AI is revolutionizing the banking industry

1. Fighting fraud detection and minimizing security risk

Thanks to the Internet and the introduction of mobile banking, banks are under increasing pressure to protect consumer data and assets from security threats. Identity theft, cyber fraud, terrorist transactions, and money laundering are all areas of risk.

If you are a human auditor, there is an undeniable probability of error occurring. Because AI can analyze hundreds of transactions in real-time, there is less risk of an error occurring. Banks also experience faster decision-making thanks to the agile nature of artificial intelligence. Blocking a fraudulent wire transfer, verifying a foreign exchange, or approving a credit card transaction can be done in a span of seconds, rather than long wait times as experienced previously.

2. Enhanced customer onboarding and engagement

First impressions are critical, and you only get one of them. This mantra has become the driving force behind banks seeking new ways to improve their customer experience.

But onboarding smoothly traditionally comes a high price, in fact, Thomson Reuters says that 92% of firms estimated that current Know Your Customer (KYC) onboarding processes cost roughly around $28.5 million each year. That’s a pretty penny for banks looking to cut costs while enhancing their customer engagement.

Lately, the answer to improving onboarding and driving customer engagement has been AI. Using new technologies like machine learning and conversational AI, customers are able to gain quicker access to the information they need, without the need to visit the branch.

Curious about the value of investing in better customer experience? According to McKinsey, “for every one-point increase in customer onboarding satisfaction on a ten-point Net Promoter Score (NPS) scale, there is a 3% increase in customer revenue.” For banks, that’s an additional $15 million per year in profit.

(Sourced from Unsplash)

3. Increased productivity due to automation

The banking industry is a conservative industry by tradition, one that relied heavily on manual processes, informal passing of knowledge among loan officers, and in-person customer service. In the past decade, banks are choosing to adopt AI to improve efficiencies on the enterprise level—everything from increasing the speed of working among personnel to faster lending lifecycles, banks are seeing accelerated rates of productivity and AI-backed customer service thanks to new technology.

For example, a bank can optimize its operations by implementing a digital overlay that connects all workflows into one comprehensive view for staff. By clearly defining roles, duties, and ways of working, the back office is able to focus less on mundane, repetitive tasks, and more on action-oriented service for customers.

One of the more powerful use cases of automation to improve a bank is COIN by JPMorgan Chase, a “contract intelligence platform that has saved the bank more than 360,000 hours of labor using bots capable of analyzing contracts with unprecedented efficiency.”

4. 24/7 customer support

Traditionally, any customer service platform is going to be limited by human factors. Call centers that operate around the clock may rely on non-native speakers or computer-automated systems that cannot address customer questions in a thorough or timely manner. With chatbots, ongoing customer support becomes a reality.

Research already shows digital communication being the preferred option, too. A recent survey by LivePerson indicates that 67% of customers prefer interacting with chatbots that provide customer support, due to their fast and efficient problem settlements. Conversational AI made possible by machine learning and Natural Language Processing (NLP) enables these bots to not only respond appropriately but converse in a way that is more intuitive and human-like.

Financial virtual assistants like Erica by Bank of America are helping banks service millions of users every year, providing proactive insights to help customers smarter banking decisions while improving their overall experience.

5. Cost reduction and efficiency

We have already covered that AI is helping the banking industry save money. These technologies offer incredible insight into customers that isn’t possible with humans. As far as deep learning, banks are able to make connections between sections of copious amounts of data. These connections can lead to reduced costs, faster decision-making, and lower complexity across systems by processing data faster than was possible before.

For example, adopting digital Know Your Customer can reduce turnaround time by up to 90%, reducing onboarding costs by up to 70%. For many banks, that’s millions of dollars every year that could be invested right back into their innovation budgets.

Banking redefined

Banks are changing more and more by the day, thanks to an increasingly volatile market and rapid changes in legislation. To stay ahead of the gain and retain their competitive edge, banks are turning to AI to deliver better banking solutions to loyal and new customers alike.

With AI, the banking industry can streamline accounting, gather and consolidate data, reduce costs from differing business branches, create an extraordinary customer experience strategy, offer 24/7 support, and substantially decrease fraud.

These insights can drive more productive business operations, omnipresent and multichannel customer engagement, and comprehensive risk identification, and compliance response, and more. AI brings banking of the future to the present, producing better solutions for tomorrow.

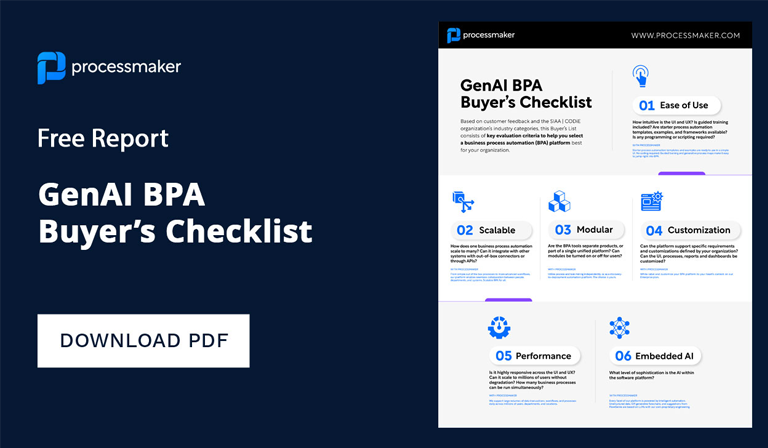

Interested in adopting AI for your bank? ProcessMaker has teamed up with robotic process automation (RPA) provider, Automation Anywhere, to help banks like yours stay ahead of the game. Read more about our strategic partnership here.

About ProcessMaker:

ProcessMaker is an American international SaaS corporation headquartered in Raleigh-Durham, North Carolina. We provide total customer support, training, and professional services to larger enterprises requiring highly-customized workflow solutions with our Business Process Management (BPM) software. Our flagship Low-Code product is the preferred choice for our customers due to its deep customization ability with little programming knowledge needed, making Low-Code an easy-to-use solution among non-technical teams.