Banks are turning to automated workflow solutions to boost efficiency and compliance, while reducing operational costs. Another important need is to improve bank customer communication in a highly competitive industry. For those new to these emerging technologies, deciding which banking process to automate and what to look for in a bank bpm solution can seem overwhelming.

Yet, by employing a strategic approach that focuses on banking processes that are suitable for automation, rather than on the end result or benefits, banks can gradually implement highly efficient processes. Moreover, when selecting the best bank process workflow management software, organizations should ensure that the solution offers certain key features.

In this article, we will explore several banking processes that benefit from automation, as well as discuss the essential components of bank workflow management software to help banks to get the most out of their workflows.

Banking process automation use cases

Traditional, manual bank processes are time consuming, lead to poor customer experiences, and are prone to human error. For instance, traditional account opening and customer onboarding processes require employees to collect large amounts of information and documentation from customers. Once collected, the information must be reviewed and manually keyed into one or more systems. Errors made when inputting information can cost banks money, as well as damage their reputations.

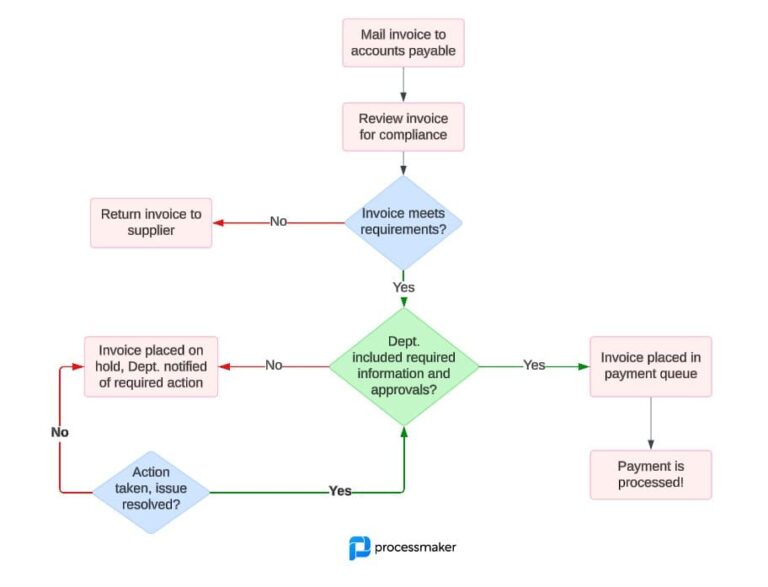

For these reasons, account opening and customer onboarding benefit significantly from automation solutions. Bank process workflow software helps organizations to automatically capture, validate, and categorize customer data as it is received. Moreover, it flags missing information and notifies the appropriate team members for corrective action. By automating their workflows, banks simplify and shorten the onboarding process, enabling them to provide great customer experiences. Banks also boost compliance by establishing audit trails.

Loan application processing and fraud mitigation are also excellent examples of banking processes that benefit from automation. With banking process workflow software, banks can reduce processing time and costs, while providing greater oversight of the application process and better customer service. Fraud workflow solutions flag unusual activity, expedite investigations, and significantly reduce mitigation costs.

5 features of banking process workflow management

An organization’s ability to automate its banking processes is dependent on the workflow management software that it chooses. An effective banking process workflow management software should offer the following:

- All-inclusive banking process automation features

- Guidance and checklists

- Omni-channel capability

- Extracts and stores data

- Integrates data into back-end banking systems

- Advanced data features and capabilities

All-inclusive banking process automation features

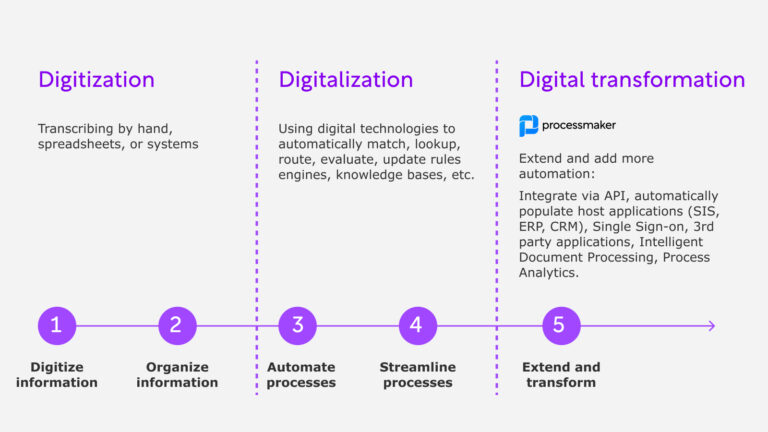

When getting started with automation, the best strategy is often to start small by selecting one or two banking processes. All-in approaches to automation often result in failure as banking processes that are resistant to change and/or not suitable for automation lead to breakdowns in workflows and systems.

It is important that your banking process solution offer the tools that you need to automate a process while also giving you the ability to automate other processes going forward. Going back to our account opening and onboarding process example, your banking process workflow software needs to collect and extract data, facilitate communication both with customers and within the organization, maintain an audit trail, streamline the decision making process, and both design and test the entire process.

Guidance and checklists

Checklists facilitate consistency in operations and boost compliance by ensuring that all requirements are met. Stakeholders rely on the checklists for guidance, while the software ensures that are tasks are completed prior to forwarding the file to the appropriate party for review.

Omni-channel capability

Customers expect that their banks will offer use and access to services across a broad range of channels. For instance, starting a loan application on a computer only to access and finish it later from a mobile device. On the organizational side, employees require tools to capture information across important channels like databases, email, websites, mobile applications, and office applications.

Once collected, captured data must be routed to the appropriate stakeholder for follow up and further action. Banking process workflow software serves to automate and integrate omni-channel interactions with back-end processes, boosting efficiency while providing industry leading customer experiences.

Extracts and stores data

We mentioned above the importance of extraction capabilities to increase efficiency and mitigate costly human errors. Banking process workflow software accomplishes this by extracting and classifying data at the field level from customer documentation. This eliminates the need for employees to manually input data and significantly expedites processing times.

Integrates data into back-end banking systems

For banking process workflow systems to work at an optimal level, they must be able to seamlessly transfer data into back-end banking systems. Integration removes the need for human intervention to input and/or transfer data. This both reduces costly errors and operating costs, while allowing data to flow to the designated party.

Banking process workflow software should also integrate data among processes and give banks the ability to expand their automation efforts into other processes.

Advanced data features and capabilities

Banking workflow automation helps organizations to leverage data to improve efficiency. One important feature is the ability to compare extracted data against existing data sources to ensure the accuracy of information. This also helps banks to spot suspicious activity and implement cost-effective fraud mitigation efforts.

Through master data management banks can look to data to make more informed decisions. This includes analyzing key performance indicators to assign organizational resources to their highest possible uses.