Banks need to profit as much as possible while providing consumers with convenient services. Perfecting your digital onboarding strategy can greatly improve the customer experience in banking. It helps financial institutions achieve both these goals at once by giving them a better way to connect with new customers.

The banking industry is undergoing a massive change.

The banking industry is undergoing a massive change. It’s not just the rise of new digital start-ups like Monzo and Revolut but also the arrival of new technologies such as blockchain and artificial intelligence (AI). These developments are driving radical changes in the way we do business, as well as how we interact with banks.

There are two key ways that banks can enhance their customer experience: firstly, by adopting digital onboarding, and secondly, by focusing on retention.

Banks that prioritize CX are more likely to succeed.

They say that when a company improves its customer experience, it’s likely to succeed. However, what does that mean? The customer experience (CX) is how customers feel about your company and its products or services. It’s how well you deliver on your promises, whether through the product itself or interactions with employees or other stakeholders surrounding the purchase of said product.

In addition to being incredibly important for consumers, CX is also an excellent indicator of business success. In fact, banks with high-quality CX are more profitable than those without it. So, improving your CX should be one of your top priorities if you’re looking to become a better marketer and build brand loyalty among customers.

Going digital can help improve the customer experience in banking.

You’re probably wondering, “What is digital onboarding?” Digital onboarding is a convenient and accessible way to onboard new customers. It can be customized to meet the needs of each customer, and it offers a range of benefits over traditional onboarding methods such as paper forms and in-person meetings.

By providing your customers with helpful resources and information, you can also provide them with financial well-being support that will help them better understand their finances and stay engaged with your bank over time.

How can you measure CX?

- Customer satisfaction surveys are a great way to measure CX.

- If you’re unsure whether your company is doing well with the customer experience, ask your customers what they think. They’ll be able to answer this question much better than you can.

- You might even want to go further by inviting them into your branch office, calling them on the phone, and asking them directly about their experiences with your business. The more personal feedback you get from customers, the better equipped you will be when it comes time to decide how best to improve their interactions with your brand.

What are the benefits of improving CX?

You’ve probably heard that improving your customer experience (CX) leads to better business results. But what, exactly, does that mean? The benefits of improving CX can include:

- Increased customer loyalty. Customers who have a good experience are more likely to buy from you again, work with you as an advisor or recommend you to others.

- Increased customer satisfaction. Customers who are happy with the quality of interactions they’ve had with your company will tell their friends and colleagues about it—and they could also become advocates for your brand! This is especially important when new products come out, or competitors start offering similar services at lower prices or better offers.

- Increased customer advocacy. With happy customers talking up how great working with your company was, it’s easier for potential customers to choose whether or not they want to give your business a shot themselves–even if there’s some doubt about what kind of service might be provided in return. There’s another benefit here: Word-of-mouth advertising costs nothing but time–which means more profit for everyone involved once all these new clients finally pull through on their promises.

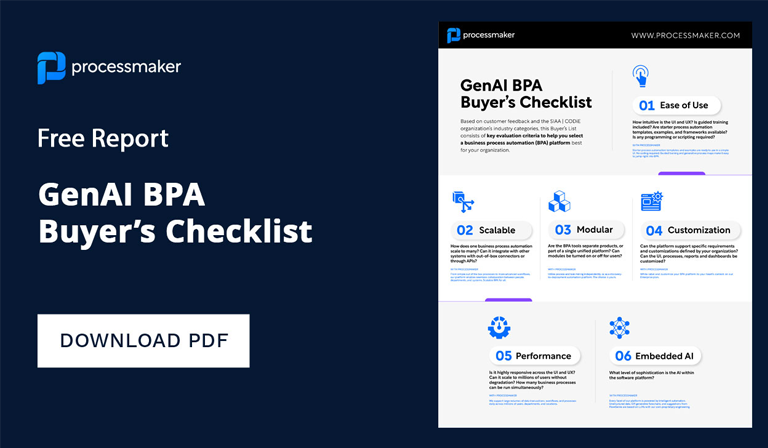

Banks must also transform to meet the needs of their shareholders. The best way for banks to keep up with this pace is by using digital technologies such as business process automation (BPA) platforms designed specifically for financial institutions that need support with data management tasks like reporting, reconciliation, or contract execution.

Further, a BPA platform can do this without sacrificing efficiency or accuracy in handling critical business operations related directly back to improving performance metrics over time through increased productivity levels within teams responsible for completing these day-to-day tasks in real-time.

Offer resources and information to improve the financial well-being of your customers.

Offering resources and information to improve the financial well-being of your customers makes them happy and more loyal. Digital onboarding is a great opportunity for banks to provide their customers with the tools they need to make smarter spending decisions, manage their money better, and save more. This will keep them coming back for years to come.

Include links throughout the sign-up process that point users directly to helpful tips or calculators that can help them learn how much money they’re spending on things like coffee every month. Make sure these links are easy for users to access; don’t force them down a rabbit hole just because you want them to use another feature in your app. Additionally, BPA can help to automate processes around sending your customers the right information at the right time.

Use digital onboarding to augment the customer experience in banking by making it more convenient, accessible, and personalized.

- Digital onboarding is a more convenient method of customer acquisition. Customers can engage with your brand in the way that works best for them. It is an on-demand service, meaning it works around their schedule.

- Digital onboarding is an accessible customer acquisition method because it can be done from anywhere with internet access, so you don’t need to worry about business hours or geographical limitations. The same goes for digital onboarding applications—they’re available 24/7.

- Lastly, digital onboarding is personalized! Your customers will feel like they’re getting special treatment because they receive a tailored solution that matches their needs and preferences (e.g., login info).

Digital onboarding improves CX by providing new customers with a more convenient and personalized experience.

With digital onboarding, your new customers can access information and make decisions at their convenience. This is more convenient for them—they don’t have to wait in line or drive anywhere—and more convenient for your bank because it doesn’t have to deal with the time and expense of physically interacting with customers. Digital onboarding saves both banks and customers time, making it a win-win situation all around.

Automation such as Digital Process Automation (DPA) can also enhance the customer experience in banking and working efficiency for employees.

Banks are in a tough place. They need to be able to provide clients with the services they need, but they also need to be able to keep up with the speed of business today. And that’s where digital process automation (DPA) can help.

With an increased number of bank customers using mobile apps to manage their accounts, banks need a way to ensure that their services are available whenever a customer needs them—even from outside of traditional banking hours—while also increasing efficiency and reducing costs. You can achieve this by automating processes via DPA.

ProcessMaker’s core features for account opening in banking:

- Core Integration: Bi-directional integration with your core solution.

- Treasury Services Onboarding: Eliminate the frustrating back-and-forth and easily onboard your business customers into your Treasury Services.

- Account Management: Add account and services, signers, request additional documents, and update customer information.

- IDA/IDV & KYC/KYB: Reduce the risk of fraud with the background check tools.

- Compliance: Stay compliant with the due diligence and AML/BSA tools.

- Funding: Cover the last mile with immediate funding options.

- Document Management and Storage: Cross the finish line with storing in your DMS repository.

- Real-time reporting: Understand every activity within the process with Dashboards and Reports.

- Market and Cross-sell with personalized offerings to your customers.

- Expand Services: Open banking concept – with RESTful API, expand your capabilities with third-party integrations.

If you implement a DPA platform to effectively manage your banking processes and workflows, then you can:

- Increase your efficiency with real-time reporting capabilities across all locations;

- Automate routine tasks so that employees have more time for personalized interactions.

- Reduce manual errors with intelligent workflow management tools.

- Improve customer experience by providing 24/7 access via self-service applications.

- Provide predictive alerts based on historical data analysis rather than a manual analysis which requires additional staff.

- Enhance accuracy with automated exception handling built into every step of a transaction.

It’s no secret that banks are looking for ways to cut costs while maintaining their competitive edge. You can use DPA to reduce the number of people involved in a transaction, which cuts down on expenses related to payroll, benefits and training for new hires.

You can also utilize DPA to avoid errors and rework caused by human error when things get busy on tasks—thereby reducing errors that could lead customers to your competition.

About ProcessMaker’s Account Opening Solution

ProcessMaker’s Next Generation Business and Consumer Account Opening Solutions delivers an end-to-end digital account opening experience. The omnichannel, unified approach allows you to meet your customers where they are – Customers can open an account online as a digital self-service process or they can come in-branch with a banker.