In an increasingly volatile and complex world, the challenges, demands, and risks faced by businesses are growing. For many business operations, continuous improvement is a source of operational efficiency – and increasingly finance leaders are turning to process mining software to achieve a competitive advantage.

In this article, we look at the opportunities, challenges, and best practices for process mining in finance operations.

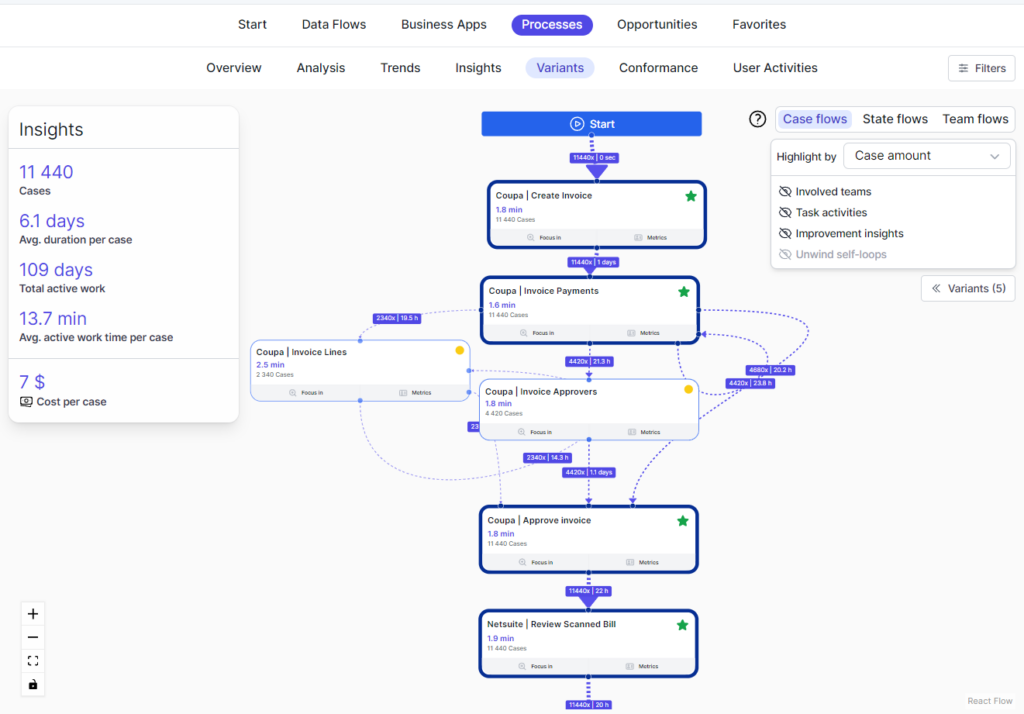

Example of finance process analysis: accounts payable processes in ProcessMaker Process Intelligence

What is process mining?

Process mining is a method for analyzing, monitoring, and improving business processes by extracting information from enterprise data systems typically in the form of event logs. The goal of process mining in finance operations is to find and eliminate bottlenecks or inefficiencies, as well as identifying areas for improvement and automation.

Process mining can be seen as an x-ray of your business or an advanced form of business process analysis. Event data is integral to this process, capturing key elements such as timestamps and activity descriptions to identify patterns and enhance operational performance. For business process management professionals, this offers some well-known opportunities:

- Process discovery – from identifying the “as-is” true state of your financial processes.

- Process mapping – defining and communicating the desired state of processes across your financial operations.

- Process monitoring – keeping track of conformance to your agreed processes and approval steps across different teams and business units.

- Process reengineering – the systematic analysis and re-design of key processes to increase efficiency.

- Digital transformation – the digitization of processes and transition to advanced cloud-based solutions.

History and evolution of process mining

The field of process mining began to take shape in 1999 at Eindhoven University, spearheaded by Dutch computer scientist Wil van der Aalst, who coined the term “process mining.” Initially, the techniques were often confused with workflow management methods.

However, as the field matured, process mining evolved into a distinct discipline, characterized by the development of sophisticated algorithms for process discovery, conformance checking, and process enhancement. Today, process mining is recognized as a critical tool for business process improvement, with a variety of commercial process mining tools available to help organizations streamline their operations and achieve greater efficiency.

Common finance questions process mining can answer

Process mining is not a silver bullet for all inefficiency in finance operations, but typically it can answer some key questions:

- How long does it take for us to process different kinds of financial transactions?

- Are there variations in our financial processes between teams and business units?

- What are the typical reasons for rework or bottlenecks in our key finance workflows?

- Are we using our IT systems, such as ERP, efficiently across different processes?

- What are the biggest opportunities for automation across our finance operations?

- What are potential risks or compliance challenges we face now or in the future?

Key process mining benefits in financial operations

- Faster lead time – for many financial operations time is money, process mining allows you to analyze and improve lead time and reduce bottlenecks slowing down financial processes.

- Improve productivity – process mining allows you to analyze and reduce manual work, for example, reducing or streamlining invoice approval steps or the need for rework from incorrect POs.

- Manage risk and compliance – process mining can help you identify potential risks in financial operations, for example, maverick buying or potential errors in payments.

- Optimize working capital – in most business operations there are opportunities to improve payment terms when you are either paying too early or getting paid too late.

- Discover automation opportunities – process mining helps identify and quantify the potential for intelligent automation in digitalized finance operations.

- Improve customer and vendor satisfaction – removing pain from transactions can help both key customer and vendor relationships.

The typical use cases for process mining in finance

The roles taken by finance operations are varied and complex, so typically process mining can bring benefits across a long list of use cases:

- Accounts payable – improve the amount of invoices that are paid on time and harmonize and improve the payment terms between different vendors.

- Accounts receivable – reduce the days’ sales outstanding (DSO) or optimize available working capital.

- Procure-to-pay – reduce the operational cost per purchase order (PO) through streamlining or automating steps.

- Order-to-cash – reduce the number of steps needed in O2C, for example, in order management.

- Accounting and reporting – analyzing and exploring where monthly processes break down or sources of bottlenecks in regulatory or financial reporting.

- Travel and expense management – making sure you have transparency on filed receipts and approval processes.

Areas of finance operations where process mining can improve operational efficiency

Process mining best practices for finance operations

- Start with a process discovery. By developing an understanding of the current process you get a realistic x-ray of the true health of your workflows within your ERP.

- Look beyond the ERP. Identify the key data sources needed to perform process mining. This could include financial transaction data, customer data, and operational data.

- Set clear objectives. Identify clear and measurable goals for the process mining exercises. This could include identifying areas of inefficiency, optimizing operational costs, or increasing the rate of digitalization.

- Evaluate time-to-value. Establish a realistic timeline to complete the process mining exercise. This should include a plan for data integration and analysis, as well as any additional steps needed to identify and achieve value.

- Invest in training and communications. Remember that process mining is a change management exercise where key stakeholders should be included, educated, and informed of progress.

- Aim for cumulative, not immediate results. Process mining is rarely a quick fix or silver bullet. Look for ways to balance both immediate and longer-term rewards as you increase the maturity of your financial operations.

Limitations of process mining for finance using event log data

- Quality of source data. Process mining software is only as accurate as the data that is used to create the process model. If you don’t trust your financial master data, you may not trust your process insights.

- Lack of visibility without event logs. Process mining software does not always provide complete visibility into the process, especially in processes or software where you don’t have event logs.

- Lack of time-motion understanding. Process mining is great at measuring event sequences in a process, but it can’t give a full picture of which suppliers or customers are most costly in time and manual work.

- See the problem, not the cause. Process mining software is good at identifying in detail challenges, but is not always able to uncover the root causes of process anomalies, variations, or errors.

- Tracking complex workflows. An average financial operation needs to operate more than 25 business applications, office tools, 3rd party portals, and government tools. Rarely can these end-to-end processes all be tracked efficiently with process mining.

Consider an alternative: hybrid process intelligence

For many financial operations, the business case for process improvement is clear – but the implementation of process mining software is a challenge. If you’ve already tried process mining or you’re still considering your options you may want to explore hybrid process intelligence software.

This new approach gives you the level of detail of task mining software while providing depth of coverage of process mining software. Not only that; it’s also known to be 10x faster in implementation than the well-known process mining solution.