Before the COVID-19 crisis, the financial institutions were experiencing large growth, despite increasing competition and consumer demands. Yet, in only a matter of weeks, financial services experienced a level of disruption that will change everything that had been the norm in banking. Banks face a major change in the way they conduct business, the way their employees do work, and the way consumers manage their finances.

Banks need to use this time of disruption to reinvent themselves to better understand the way consumers and businesses expect their financial services to support their needs. Currently, there is an opportunity to reevaluate how technology, insight, and analytics can accelerate future growth.

Marketing

Marketing’s use of new technologies powered by artificial intelligence, personalization, and real-time communication has changed the profession from an art to a science. In this time of disruption, how can marketing be implemented to help customers manage their finances and provide support during these difficult times?

According to Rohit Mahna, SVP of Financial Services at Salesforce, financial institutions need to reach out and touch consumers and businesses in a way that shows they genuinely care. Just don’t send generic emails, send solutions that are going to have an impact on people’s needs today.

For example, USAA sent this message to its customers:

“Dear Fellow Member‚

The coronavirus (COVID‐19) pandemic is changing how we live‚ work and serve you. In the last week, we have relocated most of our 35‚000 employees to work from home and are providing ongoing assistance to help them take care of themselves and their families. Our teammates remain committed to providing great service to you – even when they do it from their home office or kitchen table! A few employees offered this heartfelt message to you.”

This message was followed with ways to get in contact with reps, information on banking and delayed credit card payments, and late fees. Banks can’t be selling, which is tough for an industry that has always been focused on the product. “This is the one time when you have to take a step back and say, ‘this is not about the product, this is about the household or this is about the small business,” Mahna stated in the Banking Transformed podcast.

Innovation

Social distancing during the COVID-19 epidemic has put a spotlight on the financial organizations that have lagged behind the marketplace with digital transformation. But can the slack be picked up when the rest of the world grinds to a halt?

Jeremy Balkin, Head of Innovation at HSBC, states that “…innovation is no longer nice to have, it’s a must-have. And those who recognize the power of innovating successfully, not only having a strategy but executing on that strategy, will be the winners. “

If your financial institution is still using outdated paper-based processes, its time to rethink your workflow. Utilizing business process management (BPM) software can help you lower costs, improve customer service, and gain a competitive advantage.

Banks can automate the following processes to become innovative in their field:

- Retail Credit Approval

- Account Opening, KYC, AML

- Customer Inquiries, Complaints, and Support

- Risk Management

- FATCA and other Regulatory Compliance

- Commercial Loan Approval

- Regulatory Reporting and Oversight

- Collections and Legal Actions

- Discounts, Fee Waivers, and Credit Memos

- Expense Reports and Spending Approvals

- Employee Onboarding

- Customer Onboarding

- Policy Document Acknowledgements

- Collateral, Title, and Escrow Processes

- And many more…

Digital Banking

The number of brick and mortar branches and the number of people visiting them has significantly decreased over the years, but with the COVID-19 crisis, many are shutting their doors completely. While digital banking has increased over the years, with a 20 percent increase from 2014 to 2019, there are still non-digital natives that relied on visiting branches. How will forcing these non-natives to bank digitally affect branches once the pandemic is over?

According to Jamie Warder, EVP and Head of Digital Banking at KeyBank, “his crisis highlights how important digital capabilities and products are, and how important speed and seamless integration are. But, I think we need to ask ourselves, as an industry, are we moving fast enough?”

In order to experience digital transformation, financial organizations need to start with the ideal customer experience and how to digitize that experience. Just digitizing current paper-based customer journeys with existing technology stacks won’t do. Financial organizations should approach this process with a fresh way of thinking. Banks also need to hire the right people to get the job done with full-stack engineers, human-centered designers, and people who understand the financial landscape.

Moving Forward

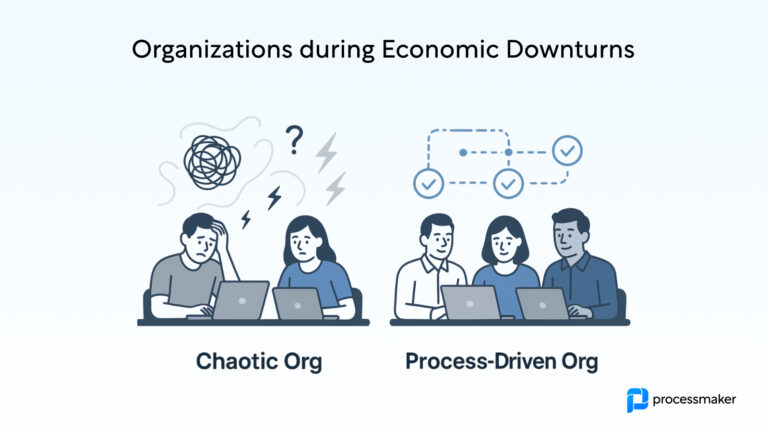

Eventually, the current pandemic will subside and society will return to the new normal. But, in the meantime, this crisis can be used as an opportunity to learn from consumers and employees alike. Some organizations will have new opportunities realized by innovations tested and marketing models that are adjusted to meet the current demand, while some organizations will be crippled under this crisis. The extent of these changes all depends on how long this crisis will be and how each financial institution will react during this epidemic.