Post-pandemic impacts on the workplace seem to have become the ideal catalyst for doubling down on process automation investment. This market is expected to reach roughly $174.17B at a rate of CAGR 7.23% by 2025 — and the market’s seeing players of all sizes get into the mix.

While many eyes have long been trained towards robotics process automation (RPA) and artificial intelligence (AI), the scope is widening. This is particularly thanks to the democratized business application development via low-code platforms. As tools become easier to use, more companies are willing to give them a shot.

But the market isn’t stopping at accessibility. Once isolated solutions are now growing into a wider melting pot for organization-wide boosts in productivity and cost-efficiency.

As disparate pockets of partial automation continue to become a competitive disadvantage, vendors grow their focus towards more comprehensive solutions to be a one-stop-shop for lean, automated enterprise workflows.

Exactly how big is process automation right now?

Today, the process automation market is expected to boom to the estimated tune of $74B. With a wealth of attention from investors and enterprise software giants alike, this category has become a heavyweight among the global automation industry.

Among those attracting interest are ProcessMaker, as well as the Berlin-based Camunda. From decade-long journeys as scrappy consultants to proven data orchestration solutions, both companies have recently achieved substantial fundraising success.

Consider Camunda’s recent $98M Series B, in which funding from Insight Partners and returning Round A investor Highland Europe puts their total investment at $126M. Meanwhile, ProcessMaker has just raised $45M in its first-ever outside investment via funding from Aldrich Capital Partners (ACP).

The intersection of RPA with tech like business process management software (BPMS) gives their clients an edge that’s becoming non-optional for efficient, competitive workflows. It’s this expansion and consolidation of process-enhancing tools that are pulling even the tech giants into this movement.

While a 19.5% growth in the RPA market from 2020 to 2021 underpins the influence of this space, it’s the low-code (also called no-code) workflow building that’s the true heartbeat to this newfound automation focus.

For instance, Microsoft acquired process automation startup Softmotive back in May of last year to expand their own low-code solution, PowerAutomate. RPA stars UIPath and ServiceNow are also branching into wider automation with their purchase of Cloud Elements and India-based startup Intellibot, respectively. Other software enterprise giants like IBM and SAP are also buying their way into the movement.

What’s with all the funding around low-code and process automation?

By allowing custom enterprise-grade automated workflow building to be as easy as creating a Powerpoint presentation, tech giants are realizing the value of buying their way into this in-demand market.

Take UIPath’s purchase of Cloud Elements, for example. Their aim is to offer custom blends of user interface (UI) and application programming interface (API)-based automation. In other words, this is yet another way for frontline employees to create and deploy their own IT-sanctioned tailormade workflow solutions faster.

Combining RPA and BPM alongside low barrier-to-entry interfaces gives any user the power to go from problem to solution — and hit production without extra IT overhead. After leveraging their expertise for automation bot rollout, 70% of employees anticipate taking more strategic roles in the workplace, much to the benefit of their wider organizations.

From the investors themselves, it seems the notions of a revolution driven by process automation isn’t far fetched.

Mirza Baig, Managing Partner at ACP spoke in the funding announcement on ProcessMaker’s proven ability to “thrive even during a once in a century world-wide pandemic.”

Scrappy operations aside, this resilience is in part due to demand. The forced move to cloud-based remote work is expected to create permanent hybrid workplaces for many enterprises.

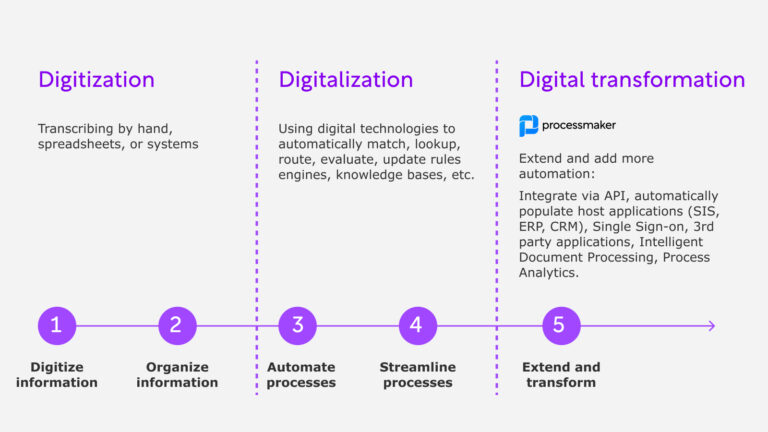

With many companies now focusing on true digital transformation, expanded automation for leaner operations is now more approachable than ever. Low-code makes this shift easier for anyone to pick up and deploy with ease, making ProcessMaker a top-of-mind candidate for these efforts.

Ultimately, startups and big tech agree: workflow automation packs a ripe opportunity to revolutionize industries globally.

Next moves for players in the process automation market?

Low-code automation’s anticipated role in transforming hundreds of industry verticals worldwide cannot be understated. But making these tools more user-friendly is only half of the larger picture: organization-wide orchestration of processes.

Camunda co-founder and CEO Jakob Freund highlights this “bigger thing going on which you could call end-to-end automation or end-to-end orchestration,” otherwise known as hyperautomation.

Simply put, RPA bots and BPM work fine alone, but only successfully scale across the entire organization when integrated together. Today’s process solution vendors are aiming to tether their own suites of hyperautomation tools like RPA, AI, process mining, and more — commonly called the DigitalOps Toolbox.

Many market players seem to share a similar end goal of becoming the all-in-one platform of choice. With clients becoming increasingly in need of scalable, integrated automation solutions, it appears that doubling down on accessible hyperautomation might make even bigger waves in years to come.