Many businesses extend credit to customers through a customer credit application process in hopes of helping them purchase big-ticket items with the convenience of paying for them over time. When the customer credit application process is complicated, customers are less likely to bother, and there are more chances for mistakes along the way.

If it has been a while since you have reviewed your customer credit application process, perhaps it’s time for reevaluation. You may be able to make significant improvements, making it faster, less error-prone, and more efficient, without a major project or expense. It’s good to start by knowing where today’s customers are coming from.

If it has been a while since you have reviewed your customer credit application process, perhaps it’s time for reevaluation. You may be able to make significant improvements, making it faster, less error-prone, and more efficient, without a major project or expense. It’s good to start by knowing where today’s customers are coming from.

What Customers Want Today

Customers today are used to doing everything online, and an increasing number of things using mobile technology. Filling out a customer credit application by hand, or phoning a contact center and relating information for them to put into forms is perceived as antiquated and a hassle. They want to go online, enter their information securely, and get a quick answer as to whether credit will be extended.

The old days of turning in paper applications and then waiting for mail or a phone call to arrive with the decision of whether credit would be offered or not are part of the past now, and if you still rely on these methods for providing customer credit, you could be missing out on a lot of applicants and their spending power.

Make Your Application Forms Smart

Electronic credit application forms are better for multiple reasons. For one, they won’t get lost (along with any personal information entered on them). They’re by definition legible, and you can design your electronic forms to ensure inappropriate answers can’t go through. For example, if a number is required in a particular form field, the form can be made to refuse submission if letters are mistakenly entered.

Furthermore, you can design your forms so that information entered one-time “waterfalls” into other related forms and fields. When a customer enters his phone number once, it can be used to fill in phone number information in multiple places at once, minimizing the chances of errors and considerably speeding up the process.

Faster Approval Means More Enthusiastic Customers

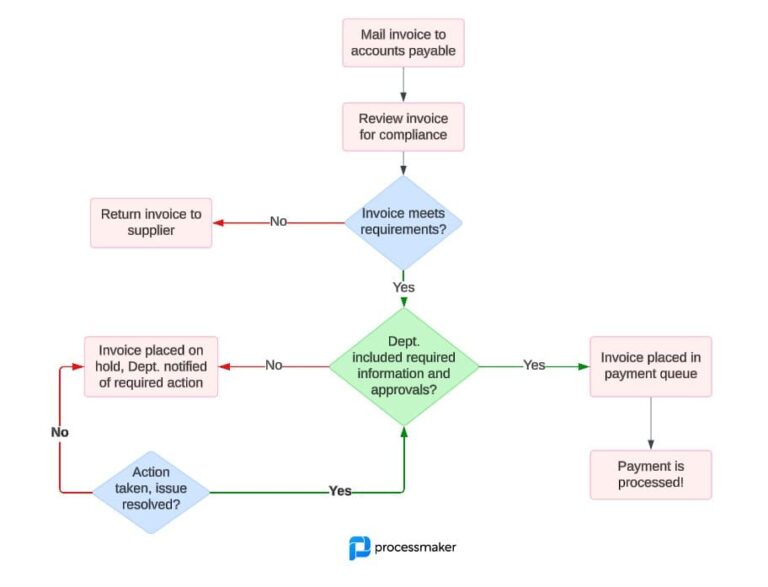

When your customer credit application process is both electronic and “smart,” it goes faster. When an application is submitted, recipients can be notified by text or email alert that their input and action is required. This is much more efficient than the paper form that hibernates under a stack of papers on someone’s desk until they discover it.

A smart customer credit application process means customers find the process less daunting, and they get their answer sooner. The sooner a customer is approved for credit, the sooner he or she can enjoy shopping with you.

A smart customer credit application process means customers find the process less daunting, and they get their answer sooner. The sooner a customer is approved for credit, the sooner he or she can enjoy shopping with you.

Simplified Credit Application Draws More Applicants

It only makes sense that a simplified credit application process draws more applicants than a drawn-out, complex process. Some businesses set up application kiosks that are convenient for in-store customers and that work similarly to how the process works on your business website. When a customer sees a high-ticket item in your store and knows he or she can get credit approval in a short amount of time, it’s an easier decision to go ahead and apply. The more customer credit applications your business receives, the more it approves, and the more customers are able to purchase from you. It’s a win for all parties involved.

Conclusion

Businesses of all types have the power to create efficient customer credit application processes through workflow software like ProcessMaker. Without having to write programming code, you can design your credit application so that it’s easy to navigate, and so that information can be used to populate multiple forms and fields at once. Approving authorities can be notified whenever their input is required so delays are minimized. There’s simply no comparison between the “smart” customer credit application designed with software like ProcessMaker and the clunky, slow, error-prone methods of the past.

ProcessMaker comes with an impressive array of built-in tools and templates, so you can develop processes like the credit application process quickly. Furthermore, you can take out the ProcessMaker Enterprise Edition for a free test drive, or download the Community Edition of ProcessMaker. There’s simply no reason your business has to be stuck with an antiquated customer credit process that today’s customers won’t bother with.