Customer identification is the first and most crucial step in a bank’s account opening process, essential in preventing financial crime and money laundering. In addition, anti-money laundering (AML) and counter-terrorist financing (CFT) are significant challenges for financial institutions worldwide.

These global standards, including the AML 4 and 5 directives and “KYC” safeguards for client identification, are progressively implemented into national legislation. Thus, it is crucial for banks to spend adequate time evaluating banking account opening products.

What role does the Know-Your-Customer (KYC) protocol play concerning bank account opening?

Banks use KYC processes to verify the authenticity of potential clients and analyze and monitor any hazards. These techniques of customer onboarding help in the detection and identification of money laundering, terrorist funding, and other types of illegal activities.

Further, KYC includes identification, face and document verification, utility bills for proof of address verification, and biometric validation. Banks must adhere to KYC and anti-money laundering requirements to prevent fraud. Also, banks are responsible for ensuring compliance with KYC standards.

Invariably, noncompliance may have serious repercussions.

Over the previous 10 years (2008-2018), the cumulative fines for noncompliance with AML, KYC, and sanctions-fines in Europe, the United States, the Middle East, and Asia Pacific totaled $26 billion. This number does not incorporate unquantified reputational damage..

KYC in account opening products

The process of creating a bank account for a new business customer is known as account opening. KYC requirements require financial institutions to collect and verify client information regularly.

Additionally, onboarding new customers in banking and financial institutions is a complex process requiring teamwork from several departments to provide a great customer experience.

The process of opening a bank account for new clients is a critical component of a bank’s compliance audits. Customers can stay current with the shifting economic landscape if banks and non-banking financial institutions (NBFCs) offer a quick and straightforward onboarding procedure. Also, taking this approach will result in a high ROI as well as an improved customer experience.

Today’s banking customers expect digital experiences for critical services. This is crucial for new banking account opening products,, which is the complete process a prospect goes through when they join a financial organization for the first time.

The bank’s account opening challenges

Banks and financial services firms will lose money due to poor customer onboarding strategies. Anti-money laundering fines seriously impacted bank onboarding operations. Banks’ KYC and onboarding processes have been tightened, resulting in a considerable increase in onboarding expenses. To put it another way, this has impacted the client acquisition process by resulting in unduly extended time-to-cash cycles, which have resulted in considerable revenue losses for the corporate customer.

Here are other issues banks must address regarding banking account opening:

- Delays, onerous processes, and bureaucracy significantly harm sales operations.

- Failure to manage client expectations across digital touchpoints as they progress through the buying process.

- Customers are more likely to sign up for extra services early in their relationship with a company if the onboarding process is quick and efficient.

- Banking customer onboarding is getting increasingly complex due to constantly changing regulatory requirements and restrictive constraints.

- Inadequate consumer data and suitable data analytics are limited when there isn’t a single view of the client’s information.

- Effectively managing the proportion of new customer accounts generated with a mistake (e.g., a typo or an inaccurate address, name, or account type) to the total number of new customer accounts created at the same period. This statistic is also linked to the KPI “Average Time To Close Issues” shortly. Essentially, there are many new accounts established with insufficient documentation.

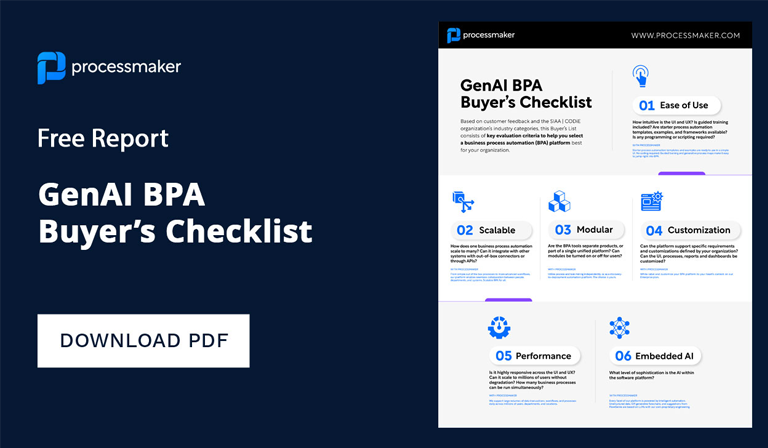

If you’re ready to improve your account opening products, here are eight crucial steps for selecting the right solution, as defined by Gartner:

Step 1: Determine your primary assessment criteria using the provider worksheet and any relevant product worksheets.

Step 2: Use the specified sub criterion and/or create your own, depending on your company’s priorities, to establish each of your parameters.

Step 3: Consider how you’ll be grading your students. The utility provides a prototype scale, but it may be modified as desired.

Step 4: Apply a valuation to each of the assessment criteria and sub-criteria that you’ve specified.

Step 5: Every supplier’s proposal should have its own tab.

Step 6: Examine and assess the service providers according to their performance in each corresponding metric. Calculate the weighted total for each key criterion using these scores. Use the aggregated data from the subcategories to calculate the overall score for each provider.

Step 7: Communicate the outcomes to your most important stakeholders.

Step 8: Analyze the highest-scoring providers to discover where they rank relative to the competition.

Improved bank account opening processes have a variety of advantages

Clients may trust the application’s source due to its consistent design and subject expertise. Further, it is vital that consumers feel at ease while disclosing personal and financial information during the onboarding process.

Customers will browse and fill out their information more quickly if a bank account opening application is simple to use. As a result, it is essential to improve the overall user experience by employing cross-platform tools to start and stop processes without interruption. Also, by linking other accounts and pre-filling form forms, customers may save time and avoid submitting documents such as account statements.

Banks located all over the world rely on ProcessMaker’s award-winning low-code BPM platform to design, automate, and manage their account opening processes. See how ProcessMaker can help your bank to offer a more efficient account opening process and boost your bottom line.