In today’s fast-paced financial landscape, the ability to quickly analyze investment opportunities and act decisively can make the difference between capturing value and missing crucial opportunities. Traditional methods of investment analysis—manually researching companies, compiling market insights, and crafting personalized outreach—are becoming increasingly unsustainable in a world that demands both speed and precision.

The Evolution from AI Assistant to Strategic Partner

AI is undergoing a fundamental transformation in the financial sector. What began as simple automation tools has evolved into sophisticated systems that function as true strategic partners in business execution. This shift represents more than just technological advancement—it’s a complete reimagining of how financial professionals interact with technology and data.

ProcessMaker stands at the forefront of this revolution with its Agentic AI capabilities.

What is Agentic AI?

Agentic AI represents the next frontier in artificial intelligence applications for business. Unlike traditional AI that simply responds to queries or generates content, agentic AI systems can:

- Plan and structure complex workflows

- Act autonomously toward defined business goals

- Execute multi-step processes across different tools and platforms

- Deliver complete business outcomes from minimal input

In essence, agentic AI doesn’t just work for you—it works with you as an active collaborator in achieving business objectives.

Real-World Application: Investment Scouting Automation

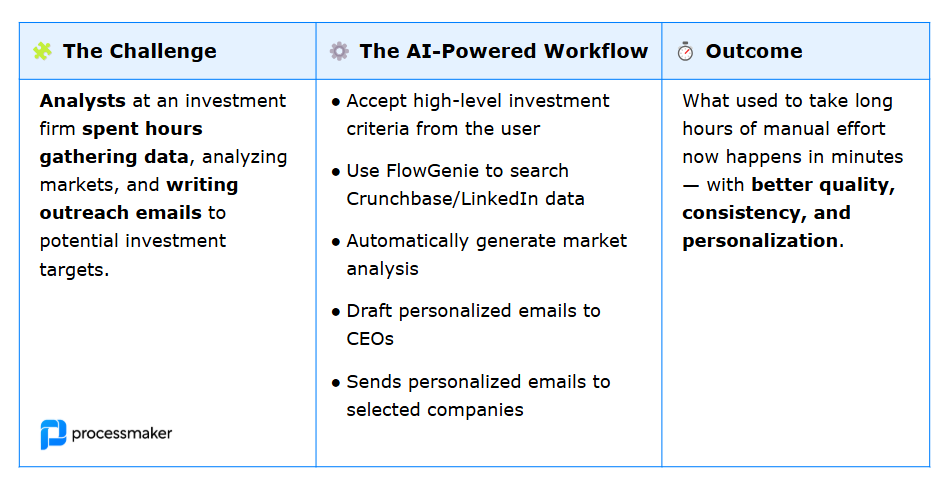

A compelling example of agentic AI in action comes from ProcessMaker’s implementation of an automated investment scouting workflow.

Analysts often spend hours researching potential companies, compiling market insights, and crafting personalized outreach messages. It’s valuable work — but it’s also highly repetitive, difficult to scale, and prone to inconsistency. Each analyst interprets data slightly differently, writes emails in their own tone, and manually stitches together resources from multiple platforms.

ProcessMaker’s solution with Flowgenie transformed this entire process into a streamlined, AI-powered workflow:

- User input: The analyst provides investment criteria — industry, geography, funding stage, and other filters.

- AI-powered data discovery: Flowgenie uses GPT to search sources like Crunchbase and LinkedIn, identify relevant companies, and extract valuable details.

- Market analysis generation: Based on the discovered data, GPT builds a concise, professional market overview summarizing trends, investment potential, and risks.

- Automated personalized outreach: For each company, it generates custom, high-quality emails tailored to the CEO or founder, incorporating insights from the market analysis.

- Workflow execution: The full package — data, analysis, and email — is pushed through a ProcessMaker workflow, and outreach is sent automatically.

The results speak for themselves: what once consumed an entire afternoon of analyst time now completes in under 10 minutes—with consistent quality, deeper insights, and the ability to scale effortlessly.

The Business Impact

This transformation delivers multiple layers of value for financial organizations:

- Time efficiency: Analysts reclaim hours previously spent on manual tasks

- Enhanced quality: Research becomes more comprehensive and consistent

- Focus on strategy: Financial professionals can redirect their expertise to decision-making rather than data gathering

- Accessibility: The solution requires no technical skills from end users

Perhaps most importantly, this approach to automation doesn’t eliminate the human element—it elevates it. By handling routine tasks and providing structured, consistent analysis, agentic AI empowers financial professionals to apply their judgment and expertise more effectively.

The Future of Agentic AI in Finance

While investment scouting represents a compelling use case, the applications of agentic AI in finance extend much further:

- Risk assessment: Automatically identifying and analyzing potential risk factors across portfolios

- Regulatory compliance: Monitoring changes in regulations and adapting documentation accordingly

- Client communication: Generating personalized updates and recommendations based on portfolio performance

- Market monitoring: Continuously tracking market conditions and alerting analysts to relevant changes

- Deal flow management: Streamlining the entire pipeline from prospect identification to deal closure

ProcessMaker is actively developing solutions across these areas, with the goal of transforming how financial institutions handle complex, data-intensive workflows.

AI as a Foundation

What sets ProcessMaker’s approach apart is the recognition that AI isn’t simply a feature to be added to existing systems—it’s a foundation upon which to build entirely new approaches to business processes.

By allowing users to describe their needs in natural language and having the AI handle the underlying complexity, ProcessMaker is democratizing access to sophisticated automation capabilities.

As these technologies continue to mature, we can expect to see agentic AI handling increasingly complex aspects of financial workflows—not just executing predefined steps, but adapting to changing conditions, learning from outcomes, and suggesting optimizations.

The Agentic Advantage

The investment scouting solution described here represents just one example of how ProcessMaker is bringing truly agentic AI workflows to life. More use cases are emerging rapidly across the financial sector, systematically removing manual work and elevating human contribution.

Financial institutions that embrace this shift stand to gain significant competitive advantages: faster time-to-insight, more consistent analysis, scalable operations, and the ability to redirect human expertise to where it adds the most value.

ProcessMaker is at the forefront of bringing intelligent automation to organizations across industries.