Imagine a world where repetitive, time-consuming financial tasks no longer weigh down your team. Where late nights spent manually tracking expenses or reconciling accounts become a thing of the past. This is the promise of finance process automation, a cutting-edge approach to transforming financial operations, boosting accuracy, and optimizing efficiency.

Automation in finance is gaining traction as organizations across industries discover its game-changing potential. But why is this shift happening now? It’s simple—today’s business landscape demands precision and speed, and relying solely on manual processes leaves your company vulnerable to inefficiencies, errors, and missed opportunities.

This article will take you on a deep dive into finance automation—when to implement it, the areas it revolutionizes, the key benefits it brings, and the challenges you’ll need to tackle. Plus, we’ll show you how finance automation software can empower your finance team to do more, faster, and smarter.

When Should You Implement Finance Automation?

Finance process automation isn’t just for massive enterprises—the benefits are accessible to organizations of every size. But the question remains, when’s the right time to take the leap? Here are some clear indicators that your finance team is ready for automation:

- Repetitive tasks overwhelm the team

If your staff spends more time handling mundane tasks like invoice processing than on strategic initiatives, automation can free up their time for value-added activities.

- Manual errors cost you money

Human errors in expense reports or reconciliations can result in unnecessary costs. Automation helps you increase accuracy in repetitive activities.

- Compliance is a struggle

Does the thought of an audit send your team into panic mode? Automating workflows ensures your team meets compliance standards and maintains proper documentation.

- Scaling is on the horizon

If your company is growing rapidly, manual processes won’t keep up. Finance automation can scale with your business to handle increased complexity without adding headcount.

Key Areas where Finance Process Automation Shines

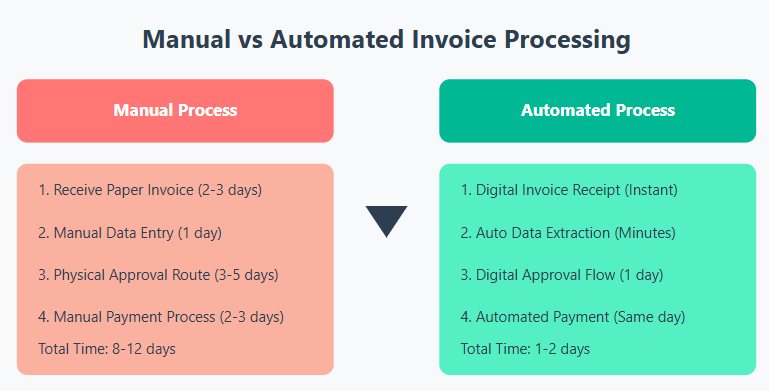

1. Accounts Payable Automation

Automating your Accounts Payable (AP) process can revolutionize the way you manage your financial operations. It not only digitizes receipts and invoices, but it also validates this information, thereby eliminating the chance of human error. Automated systems can also schedule payments, managing your cash flow and maintaining relationships with suppliers by ensuring timely payments.

Examples of tasks in AP that would benefit from automation include:

- Processing and digitizing incoming invoices

- Information validation for accuracy

- Scheduling vendor payments

2. Expense Management Automation

Expense management is often a complex and time-consuming task. However, finance automation tools can streamline this process by automatically processing and categorizing expense claims. These systems also enforce policy compliance, thereby avoiding fraudulent or erroneous claims. Finally, your employees are reimbursed faster, increasing job satisfaction and productivity.

Tasks in Expense Management improved with automation:

- Processing and categorizing expense claims

- Enforcing policy compliance checks

- Speeding up reimbursement processes

3. Financial Reporting Automation

Automating financial reporting can drastically reduce the time taken to prepare reports, freeing up your finance team to concentrate on more strategic tasks. Automation tools provide real-time data analysis, customizable dashboards, and error-free insights, enabling you to make smarter and more informed decisions.

Tasks in Financial Reporting improved with automation:

- Data compilation for report generation

- Customization of financial dashboards

- Real-time data analysis and reporting

4. Payroll Processing Automation

One of the most crucial yet time-sensitive finance tasks is payroll processing. Automated payroll systems simplify this process by ensuring timely and accurate wage distribution, while also factoring in tax obligations and benefits. This reduces the risk of costly mistakes and ensures your staff receive their salaries on time, every time.

Tasks in Payroll Processing improved with automation:

- Calculation and distribution of wages

- Factoring in tax obligations

- Accounting for employee benefits

The Benefits of Finance Process Automation

Here are the advantages process automation offers at a glance:

- Time savings – Automating repetitive workflows lets your team focus on strategic projects instead of admin-heavy tasks.

- Cost efficiency – Eliminate the financial impact of errors and reduce mundane labor costs.

- Higher accuracy – AI and automation tools ensure precise, reliable outputs in calculations and data processing.

- Improved compliance – Built-in audit trails and real-time updates keep you ahead of regulatory requirements.

- Faster processes – Automation enables instant approvals, real-time data syncing, and quicker decision-making.

- Scalability – Easily accommodate business growth without overwhelming your finance department.

The Challenges of Finance Automation

While automating the financial processes brings a wealth of benefits, it may come with a few challenges worth considering before implementation.

- Change resistance

Successful adoption requires change management and thorough employee training since sudden changes may cause some change resistance from employees.

- Budget constraints

Implementing finance automation software requires an upfront investment. Depending on the solution, the size of your company and the finance department, and the activities you’d need the software for, this number can go up to hundreds of thousands of USD a year. However, the ROI often justifies the cost within a short time.

- Integration issues

If existing systems don’t integrate seamlessly, it could disrupt operations. Choosing adaptable and integrative software that integrates with other apps easily ensures a smoother transition.

- Data security

With sensitive financial data at play, maintaining robust security protocols is a necessity to prevent breaches. It’s important to ensure that the software follows universally established guidelines like GDPR, SOC, etc.

Case Studies

Iris Neofinanciera, a pioneering financial service provider and fintech platform developer in Colombia, faced significant operational challenges due to outdated technology that hampered their ability to offer efficient customer service. The adoption of the ProcessMaker, equipped with AI-powered automation and key Business Process Automation capabilities, transformed their operations.

Their formerly inefficient and time-consuming loan approval process was significantly accelerated, reducing the processing time from weeks to a few hours. This transformation not only improved customer satisfaction but also streamlined the application process, making it more user-friendly. The enhanced traceability provided by ProcessMaker improved the monitoring, transparency, and management of credit operations, driving both operational efficiency and regulatory compliance.

Make Finance Automation Your Competitive Edge

There’s no denying it—finance process automation is not just the future; it’s the present. By recognizing its potential, adopting the right tools, and managing implementation effectively, you can transform your financial operations.

It’s time to stop sweating over spreadsheets and start focusing on strategy. Empower your finance team with an award-winning automation software ProcessMaker to streamline your workflows, increase efficiency, and elevate your bottom line.

Schedule a Demo Today and see how ProcessMaker can revolutionize your financial processes.