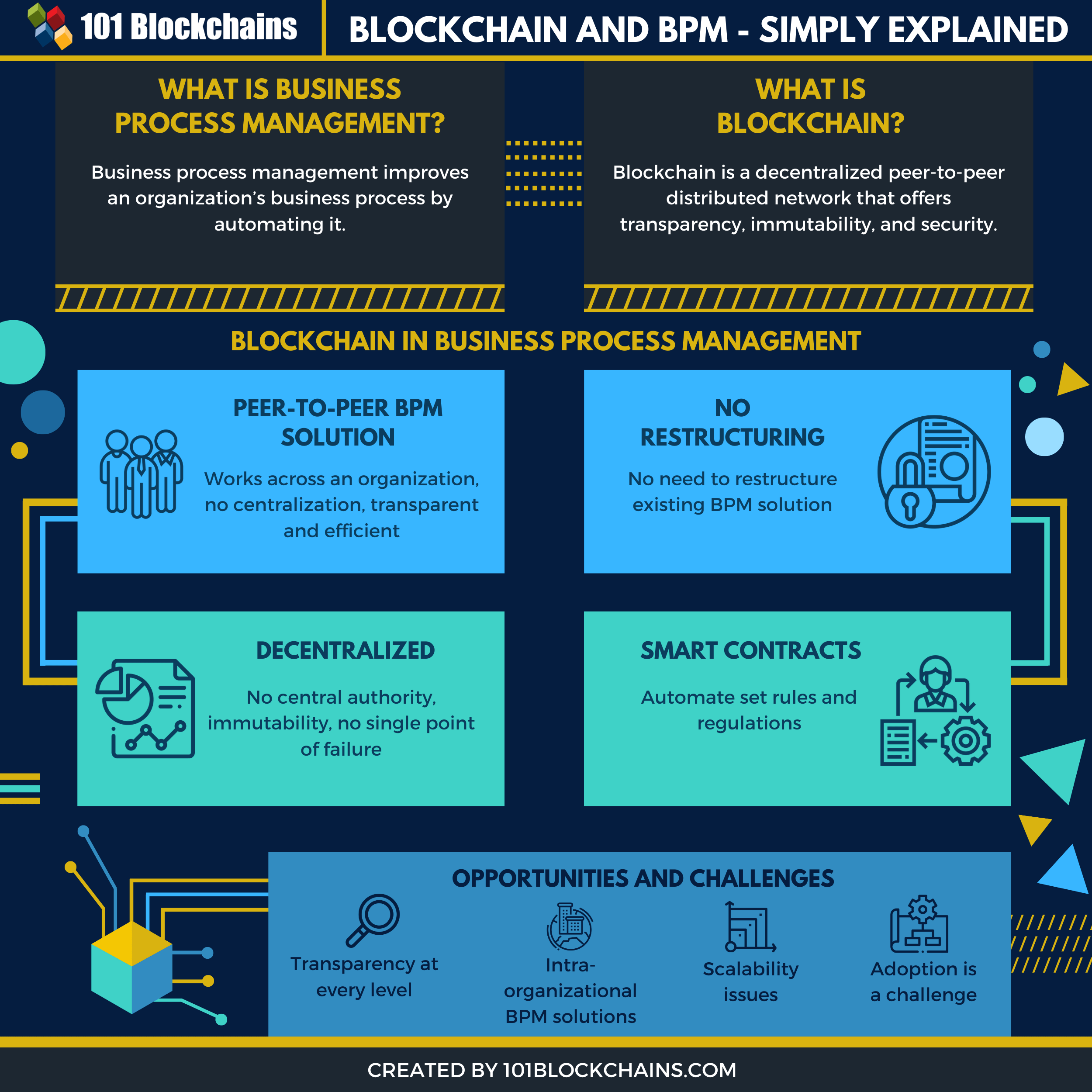

As technology advances continue to disrupt business environments, it is essential for every organization to invest in transformative breakthroughs in technology to take their business to the next level. While some finance organizations already use business process management (BPM) platforms, most are unaware of how they can take advantage of combining blockchain technology and smart contracts with their existing workflows.

When most people think of blockchain, their understanding is limited to Bitcoin and payments. Blockchain’s innovative power stems from allowing parties to transact with others they do not trust over a network in which there is no trust. The road to implementation of blockchain at the enterprise level is still fully uncharted, but there is definitely a fit for blockchain in financial services as a communication layer for BPM.

BPM and Blockchain

BPM consists of the design, execution, monitoring, and improvement of business processes. According to a paper called, Blockchains for Business Process Management –Challenges and Opportunities, while intra-organizational processes have been used by systems to support the enactment and execution of processes, inter-organizational processes, the challenge of joint design and lack of mutual trust, still need work.

Emerging blockchain technology has the potential to change the environment in which inter-organizational processes are able to operate. Blockchain offers a way to complete processes in a trustworthy manner, “key aspects are specific algorithms that lead to consensus among the nodes and market mechanisms that motivate the nodes to progress the network.”

Blockchain technology facilitates the creations of a peer-to-peer BPM system that eliminates the central repository of information and allows organizations to exchange information directly with one another. This enables organizations to verify and enforce that specific steps are being taken and performed correctly by anyone on the network. This also allows for organizations to be the sole proprietor of data generated by their own organizations and related parties. This means data cannot be locked by a third-party application or provider.

Blockchain also offers another concept that is important for any business process, smart contracts. For example, the Ethereum (global, decentralized platform for money) blockchain supports a Turing-complete programming language for smart contracts, “The code in these languages is deterministic and relies on a closed-world assumption: only information that is stored on the blockchain is available in the runtime environment.” A smart contract code is deployed with a specific type of transaction. The deployment of smart contract code to the blockchain is permanent. Once deployed, smart contracts offer a way to execute code directly on the blockchain network.

BPM, Blockchain, & Financial Services

Blockchain can facilitate processes involving multiple parties following specific regulatory guidelines by leveraging smart contracts and distributed ledger technologies. In these cases, blockchain is being used as a way to share documentation, facilitate communication, and track the statuses of transactions.

For example, when dealing with regulated transactions that require specific guideline compliance, users of blockchain systems can code guidelines into smart contracts and the verification of the other party conforming with those guidelines can be performed by the counterparty. This is essential when dealing with regulatory compliance.

Blockchain can also solve the issue of internal fraud. Consider the recent headlines of Wells Fargo (WFC) fraud cases where employees were opening up fake accounts for Wells Fargo customers. WFC said it has found a total of 3.5 million potentially fake banks and

Credit card accounts. If WFC used blockchain technology, the blockchain network and smart contracts would enforce transaction rules on the WFC’s employees so they wouldn’t be able to open fake accounts and bypass rules and regulations.

Blockchain and smart contracts can provide key features to BPM platforms as they make transparency fully realizable:

- Blockchain can verify and settle financial transaction disputes in seconds or minutes

- It can increase the accuracy and security of transactions

- Removes opportunities for fraud and human error

- Transaction costs decrease

Conclusion

While BPM and blockchain technology has great potential in financial services, adoption is one of the biggest challenges. Blockchain is an emerging technology which means that implementation can be a risky endeavor if developers are unaware of the technology stack. It is not an out-of-the-box solution either, as financial services organizations need to take into account the workflow, use case, and local laws and regulations.