Expense reporting processes can be difficult to get right. On the one hand, you want to make it simple, so employees will submit expense reports on time and accounts payable can reimburse them promptly. On the other hand, you don’t want expense reports to be so casual that it’s easy for employees to claim frivolous expenses.

On the other end of the spectrum, overly complicated expense reports can lead to resentment from employees, who may be tempted to exaggerate expenses to make up for the hassle of filling out the expense report in the first place. In general, asking for price and date information plus receipts is reasonable for companies that don’t use a flat per diem rate. Here are some ways you can accelerate the expense reporting process.

On the other end of the spectrum, overly complicated expense reports can lead to resentment from employees, who may be tempted to exaggerate expenses to make up for the hassle of filling out the expense report in the first place. In general, asking for price and date information plus receipts is reasonable for companies that don’t use a flat per diem rate. Here are some ways you can accelerate the expense reporting process.

Forego Paper Wherever Possible

Paper expense report forms can be illegible, easily lost, and prone to errors. Making expense report forms electronic, and allowing JPEG photos of receipts or electronic receipts can address these issues effectively. If an employee can’t get an electronic receipt, he can snap a photo of a receipt with his phone and use that with the electronic expense report. This way, you avoid lost or coffee-stained forms, illegible handwriting, and smudged ink on receipts.

Additionally, electronic expense reporting can be designed to step users through the process methodically. One set of steps may be used if the person attended a scientific conference, while another set of steps may be used if the employee was meeting with a client. The workflows can be designed to accommodate the types of business travel your employees do most often, ensuring that no steps are left out, and all legitimate expenses are reimbursed.

Electronic Workflows Keep Expense Reports on Track

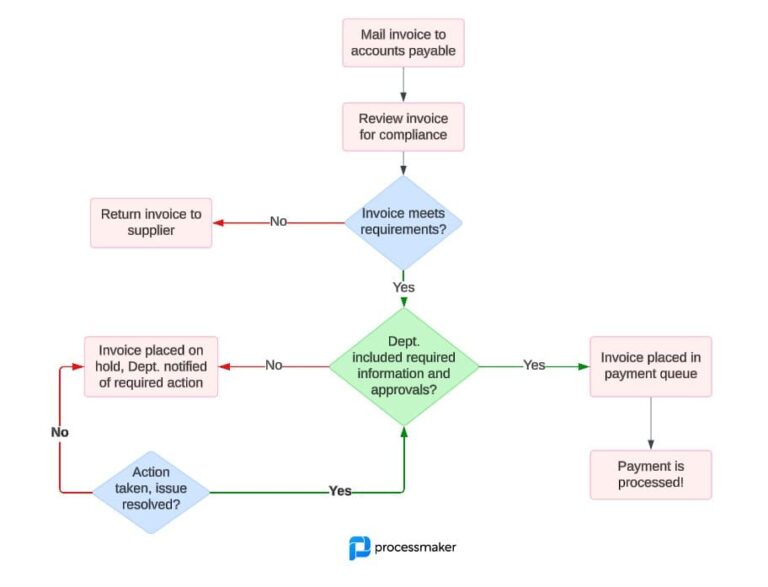

You can integrate electronic forms and receipts into a convenient online workflow that allows employees to fill in expense reports, attach electronic receipts, and then submit them online so that the proper approving authorities are automatically notified that their input is needed. When approving authorities OK an expense report, they can then submit it to accounts payable, who can be automatically notified and begin the reimbursement process. If there’s a problem with an expense report, the employee can be alerted that more information is needed.

Making Expense Reporting Procedures Mobile Is Even Better

Waiting to arrive back at the office with a pile of receipts to fill out an expense report form is inefficient. But if you make your electronic expense reporting workflow mobile, you add an extra layer of convenience for your traveling employees. When an employee can use her tablet to work on an expense report during a layover, and then finish it on the train to work the next morning, she can be confident reimbursement will be quick and can deal with more important things once back in the office.

Electronic Expense Reporting Makes Audits Easier

Whether or not your expense reporting is audited by outside agencies, most companies want to evaluate their expense reporting process periodically. When the process is paper-free, online, and mobile, audit trails can be assembled automatically as steps are completed, and there is always a record of who approved what. If questions arise, it’s much easier to re-check an electronic expense report than it would be to dig through a file cabinet and hope that all the receipts managed to stay attached.

Updating Procedures Becomes Easier Too

Paper expense report forms can become outdated quickly. Per diem rates and mileage rates change from year to year, and maybe different for different locations. With electronic expense reporting, changing these parameters is simple, because you change them once and don’t have to worry about whether someone is using an outdated form. If the calculation used to determine reimbursement changes, it can be changed once in the workflow and immediately apply to everyone. You can be confident that each employee is using the latest expense reporting tool at all times.

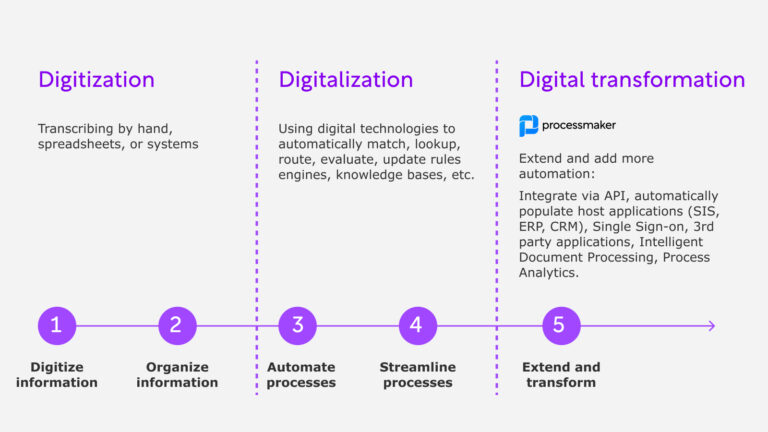

Workflow software is the key to making expense reports efficient and accurate. ProcessMaker is open-source workflow software that non-IT professionals can use to create expense reporting forms and workflows or any other type of electronic workflow. ProcessMaker has a number of built-in tools and templates to help you get started, and because it’s open-source, your IT team can customize it even more if you want. Best of all, you can test drive the ProcessMaker Enterprise Edition for free, or download the Community Edition of ProcessMaker. It’s the toolkit you need to modernize and streamline your expense reporting process.