The Problem

As one of the world's leading international insurance providers, they previously used traditional process and task mining tools with minimal success. They weren't satisfied with the outcomes and wanted to improve visibility on its complex underwriting process.

The process for underwriting new insurance was complex. The client wanted to understand the process reality and where the time actually goes in every step. More traditional methods of mapping the processes were not successful in solving this visibility challenge due to the following:

- There was a multitude of business applications involved in the process.

- 90% of all processing work happened outside of the main underwriting business app.

- here was a mixed legacy and modern IT landscape.

To make the underwriting process more efficient, an overhaul was needed beyond the scope of basic process and task mining tools.

The Solution

With ProcessMaker's Process Intelligence, the insurance organization analyzed the entire underwriting process, including its internal teams, business partner teams, and dozens of shared business applications and tools.

E - Eliminate

ProcessMaker's Process Intelligence unveils overlapping, duplicate, and pointless work in process steps for more meaningful work and quicker returns.

S - Standardize

ProcessMaker's Process Intelligence shows various teams’ methods to identify the most effective way of working and become a fully optimized organization.

A - Automate

ProcessMaker's Process Intelligence reveals manual work on business apps to show quickly automatable process steps and long workflows for RPA.

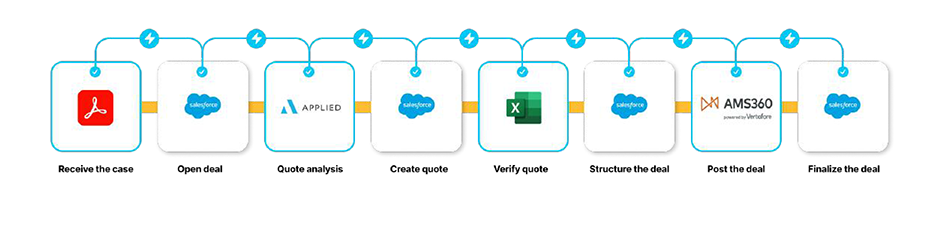

Above is the visualization of the underwriting process challenge

The Value Created

Within 4 weeks of using ProcessMaker Process Intelligence, the client was able to successfully identify the most important improvement areas for their operations. The findings were surprisingly very different from the initial assumptions, proving once again that the reality of work can be vastly different from what’s expected.

€5 million worth of annual savings potential was identified in the following four main aspects:

Manual work

The findings revealed millions of instances of copy-pasting between the main system and its supporting systems, despite the expectation that these systems would be fully integrated.

Compliance

Even though the customer has mapped out the processes and set the standard process path, the variance was found to be over 90%. There was a lot of potential to improve throughput time and cut manual efforts with the standardization of the processes.

Operating model

The majority of process work happened outside the core ERP system, e.g., in communication channels even though all customer interactions should take place within the ERP itself.

Standardization

The divergence between different teams in their efficiency was very high. The best practices from one team could therefore be utilized for other teams as well.