Are you putting relationships first in your bank’s customer experience? With over 2 million banking complaints in the UK alone in 2019, your customers might say otherwise. If you’re looking to improve customer service, an upgrade to your digital experience might be the gap you’re missing.

Today’s customer expects personal, relevant, accessible-anywhere experiences when they interact with businesses — and modern finance is no exception. With new post-pandemic norms setting in, digital-first service keeps customers connected to your offerings anywhere they need them.

From your frontend apps and websites to your back-office operations, every touchpoint has a hand in the customer experience. Let’s explore some ways you can release the friction for a lasting positive impression.

1. Leverage intelligent bank onboarding approvals

Onboarding can sometimes feel painstakingly surgical — which often ends in frustration for the customer. Balancing security and convenience doesn’t have to be ever-elusive if you have a better process to make reliable decisions faster.

Savvy modern banks are leveraging machine learning (ML) to learn their customers faster. By picking up on past applicants’ patterns and navigating your preset rules, automated decisions can be made for your team. Less time tied up in weighing risk ultimately means faster turnarounds and a better chance for customer loyalty.

2. Expand self-service to improve customer service

Sometimes the best way to improve customer service is to allow customers more ways to serve themselves.

Consider that roughly 4 in 5 bank customers try fixing issues on their own before leaping into live service. Unfortunately, limited mobile apps and dated websites discourage this DIY attitude. Meanwhile, competitors tempt customers to switch as they become increasingly digital-first.

With many opting to skip in-branch service, bringing essential services online such as account opening can enhance your bank’s appeal.

If your customers run into hangups, they’ll need a remote tool to resolve them. AI chatbots extend beyond the basic skills of yesterday’s FAQ bots. Customers instead talk with a digital assistant that remembers previous conversations.

Artificial intelligence supports predictive, CRM-fueled advice, tips, and recommendations to serve users with less friction than live human agents.

As a result, they get back to real life faster with the results they expect — and you have a satisfied customer. Your live agents can then focus more time on escalated, complex issues that chatbots cannot.

3. Centralize your bank omnichannel experience

Unthrottling the limits on where your customers can be served can, ironically, bottleneck how quickly they’re served.

When a customer starts an interaction with a chatbot, then escalates to a live agent via phone, the handoff of existing information should be effortless. Similarly, your clients shouldn’t have to restart their applications if they want to complete them later or on another device.

Consider integrating an omnichannel platform to give your teams an authoritative view of customer data across every touchpoint, regardless of department.

With a central hub to track, retain, and condense every bank customer communication, different departments can avoid retreading the same ground with clients again and again.

Whether on your website, in-app, or in-branch, you’ll find it important to bridge the seams of the customer journey. Expanding visibility is a strong way to improve customer service in banking.

4. Humanize your digital experience

Your financial institution might be concerned about losing the human warmth and relevance in your customer journey. Fortunately, AI offers two key benefits to maintain this invaluable part of your service experience:

- Remembering your customers

- Maintaining your brand voice

At each touchpoint, traditional reps recall and sift through customer records for the right info. More importantly, your live agents serve this info through an on-brand voice they’ve gained through deliberate training.

With the integration of CRM data and pre-production training, ML algorithms give digital assistants the ability to speak in a natural, humanlike way. Impersonal menu navigation turns into guided, knowledgeable help that knows how to rapidly meet a customer’s expectations.

5. Revitalize your digital experience

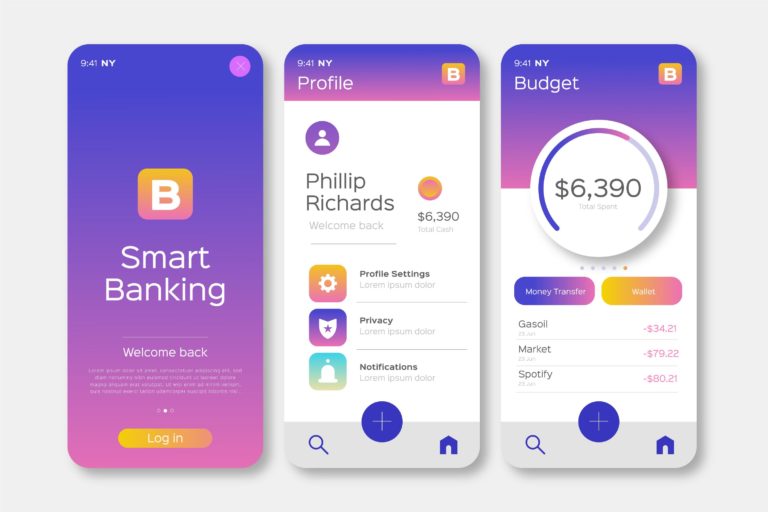

Being omnichannel isn’t enough if your customer-facing portals feel stale and shallow. Each platform needs a digital-friendly service experience that gets customers what they need — regardless of the device they use.

For example, customers can be easily frustrated if they try to open a new credit card from a mobile device, only to be redirected to a full-size desktop webpage. Worse cases may involve forcing customers to physically sign documents or come into a branch to even begin the process.

Mobile-first banks are prepared against shifts in device preference with the flexibility to meet their customers wherever they are.

After all, mobile users have already exceeded those of traditional online banking. Dynamic interface design and full-featured portals on any platform feel more approachable, ultimately keeping customers loyal.

Giving an end-to-end digital facelift can also involve moving away from strictly manual and paper-bound processes.

Managing documents via electronic signatures and other tools can streamline your backend to improve customer service. Even when leaving room for customers who prefer paper, digitizing behind the scenes will help you keep all their information at your team’s fingertips.

6. Eliminate inter-department redundancy

Centralizing your customer data also reduces how often customers are asked for the same information again and again.

From fraud risk assessment to credit approvals, departments often have their own missions when gleaning data from customers. Wastefully, many banks pass customers down a line of repeat requests to email documents and re-verify errors already obtained elsewhere. Internally, the same occurs across departments like bad deja vu.

Automating the back office to share data can cut back on these tedious redundancies. Leveraging automation can eliminate countless wasted hours and overtime costs on re-entering minor info changes that expose you to endless human error.

For instance, your reps — digital and human — can collect and centralize data for a single real-time view into a customer’s journey, while automated systems check it for accuracy. With the right tech implemented, these automations can trigger humanless email follow-ups to make corrections directly in your records.

Accurate, reliable data keeps your service speedy while keeping your bank compliant and audit-ready.

7. Offer 24/7 real-time customer service availability

Finally, emphasizing an anytime-anywhere customer experience in banking can reinforce your commitment to better service.

As an example, intelligent automated digital assistants can support your customers with humanlike responses long after business hours. Furthermore, linking your services across multiple channels can emphasize your flexibility for a uniform experience.

To reliably improve customer service, you have to first know your customer journey. You also need to know your employees’ day-to-day workflows. Process mapping can lay out every touchpoint to give you clarity into the biggest pain points — and their true causes. Automating for around-the-clock service gets much easier with intelligent business process management software (iBPMS) like ProcessMaker. Connecting — or hyperautomating — your departments’ isolated automations into an organization-wide effort ultimately passes on the benefits to each of your customers.