If you’re new to robotics process automation, now’s the time to lay the digital groundwork. For ProcessMaker users, it’s easy to integrate RPA into your BPM. Our integration with common RPA providers, such as Automation Anywhere and UIPath, helps make it painless to start using this remarkable tool in your business process management strategy.

Why should you explore robotic process automation (RPA)? Well, according to TechJury, the people of the planet will generate 463 exabytes of data per day by 2025. In each of these bits and bytes are banking transactions, chatbot conversations, loan applications, expense reports, Zoom all-hands meetings, Fortnite, and The Dark Knight trilogy in 4K.

It will become nearly impossible for industries that handle a heavy data load (like banking, healthcare, and education) to manage it all using old-school, manual methods. To bear some of the brunt, ProcessMaker users are turning to Automation Anywhere integrations to hand off data handling tasks to RPA software.

What is robotic process automation?

Robotic process automation (RPA) is an automated technology that uses software to perform computer tasks without human intervention. An armada of RPA bots can take the rote, the repetitive, and the time-consuming off your plate to boost efficiency and productivity amongst your team.

Why has RPA become such a powerful workhorse in the BPM arsenal of top organizations? Simply put, RPA is a paragon of obedience. Give these busy bots a set of marching orders, and they will get to work on your behalf. They can autonomously perform all kinds of digital dirty work like:

- Transfer information from a customer service chatbot into a spreadsheet

- Populate bookkeeping software with PayPal transactions

- Extract line items from a receipt into an expense report

- Compile fares from various airlines

- Copy and paste information from publicly available social media profiles into a sales outreach sheet

- Or, in the case of the example we will review today, RPA bots from Automation Anywhere can pull data from a third-party database right into a ProcessMaker workflow.

With RPA, the sky’s the limit: any process with a pre-set canon of rules to abide by, RPA can follow them.

You might ask: how are RPA and BPM different? When considering RPA vs. BPM, you can use this lens: BPM is the end-to-end picture of all the processes, tasks, and activities that churn through your organization, while RPA is one tool you can use to perform the tasks.

What are the top benefits of RPA and BPM integration?

RPA is more than a nifty parlor trick. Used effectively, it can have a sweeping impact across your entire organization. Some of the benefits of using RPA automation:

- Eliminate the risk of human error

- Answer customer requests with near immediacy

- Perform tasks predictably

- Rapidly assemble actionable information for sales or analytics

- Scale operations

- Improve compliance

- Free staffers to lend their creativity to more productive projects

RPA is not a passing trend: analysts predict the market will grow from $1.61 million in 2021 to a whopping $7.64 billion by 2028. Below, we’ll walk you through a simple example so you can seize the opportunities offered by RPA.

However, while all organizations should utilize RPA and BPM technologies, they should not be mutually exclusive. Instead, use them in conjunction. BPM is more than a binder. When you analyze the jobs themselves, you’ll see that processes favor complex patterns to arrange them. Consider the several coordination levels, subtasks, delegates and substitutes, consultations, and status reporting.

ProcessMaker BPM + Automation Anywhere RPA bots integration tutorial

Automation Anywhere is one of the most prominent players in RPA, and they have several tools available to help kickstart your ProcessMaker workflows with handy bots.

Let’s dive into a brief tutorial that uses a loan application workflow as an example. We’ll see how ProcessMaker BPM can utilize an RPA tool like the Automation Anywhere integration to support a simple loan application workflow. You can also follow along in the video walkthrough.

1. Customer fills out personal information

1. Customer fills out personal information

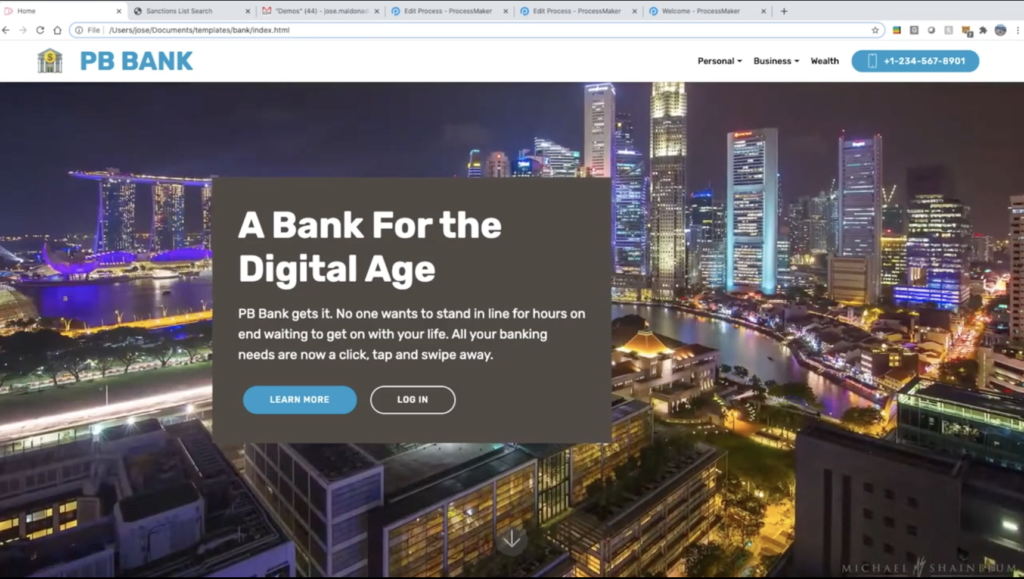

Let’s say a customer, Peter Brown, is interested in applying for a loan with PB Bank. PB Bank has been hard at work on designing a delightful digital onboarding experience for their customers. So Peter heads over to their website to fill out an online application.

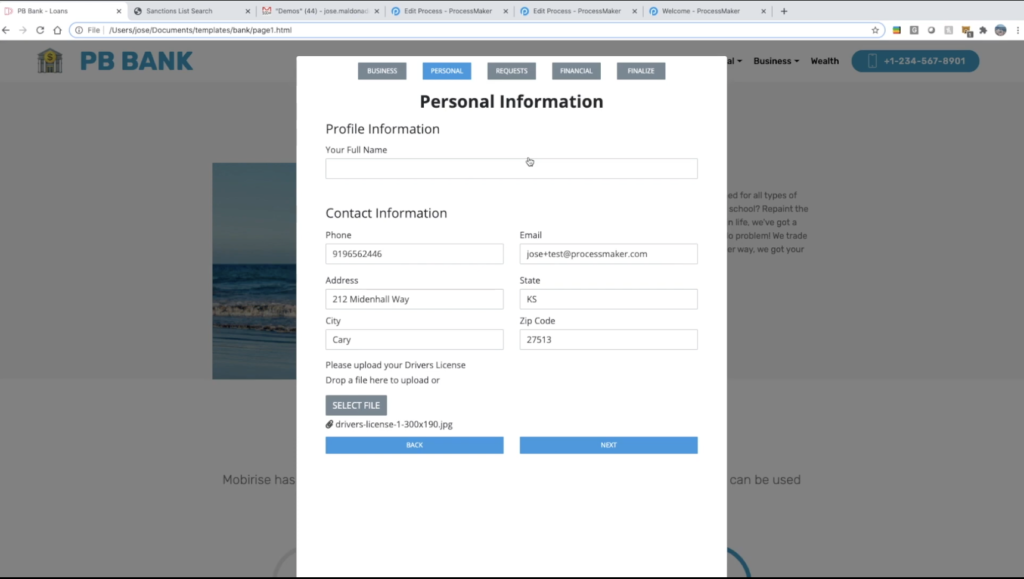

Peter fills out his personal information, and in the background, a squadron of RPA bots will get to work.

PB Bank wants to use these digital workers to check Peter’s details against the Sanctions List published by the Office of Foreign Assets Control. This particular database contains information on high-risk individuals whom banks should not engage in business with—it’s one that many banks check with when performing Know Your Customer and Anti-Money Laundering background checks.

Performing this process manually, a PB Bank loan analyst would log in to the OFAC website and type Peter’s details into the search bar. For a single applicant, this process doesn’t take all that long. But imagine doing this for the thousands of loan applications processed each day. You’d never be able to keep up.

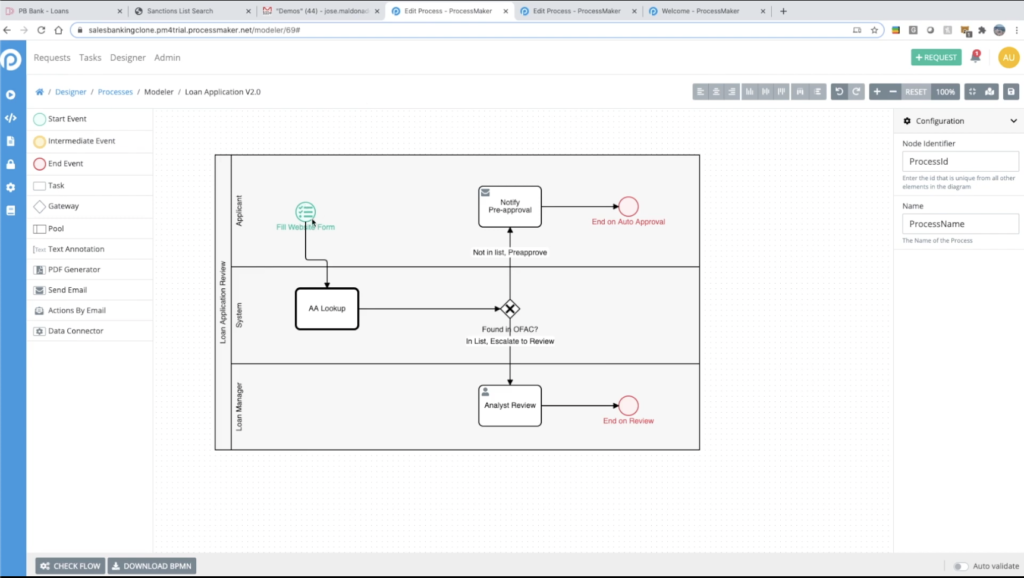

This simple process involves four steps. Let’s jump in and see what it looks like in ProcessMaker:

2. RPA initiates AA Lookup within ProcessMaker

2. RPA initiates AA Lookup within ProcessMaker

The customer starts by filling out the website form to initiate the workflow.

In the second step, “AA Lookup,” we’ll ask our Automation Anywhere bots to have a peek at the OFAC database for us. Once you’ve created this task, you can easily drag it around your workflow or even recycle it into other processes.

Depending on what they find, the system will then perform one of two tasks: send the green light to Peter via email or red flag his application for further review.

We’ve immediately cut down on the loan manager’s work—they don’t have to wade through every single application, only those who’ve triggered an OFAC alert.

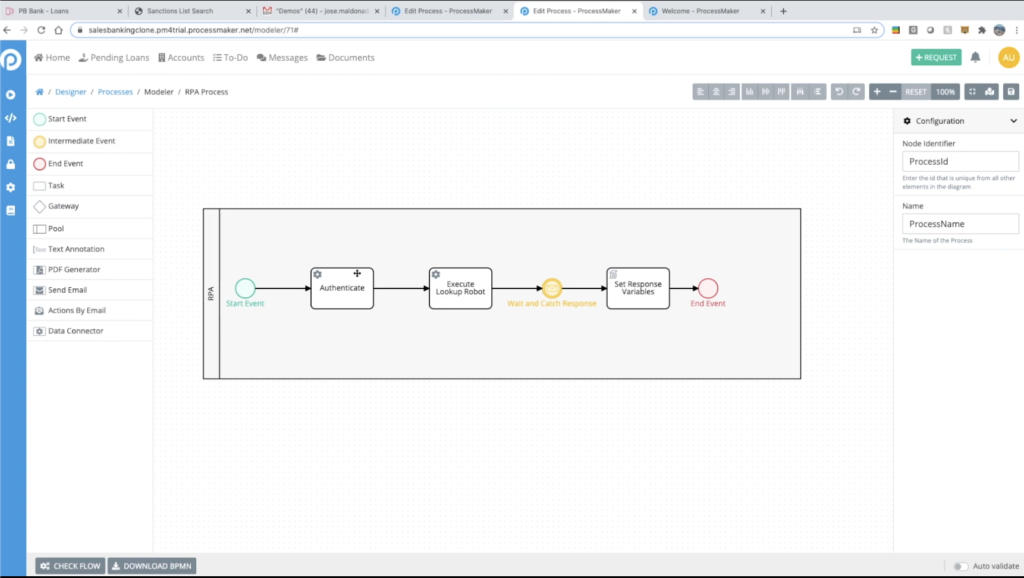

So let’s put Automation Anywhere to work on the “AA Lookup” task in this workflow. To do so, we’ve called upon a few of their handy data connectors:

- Authenticate: We ask for permission to perform the database lookup.

- Execute Lookup Robot: Here’s where the magic happens.

A friendly RPA bot will step in and do all the manual legwork for us. In the background, invisible to us, it will open up a browser, punch Peter’s information into the database, and click the ‘Search’ button.

- Wait and Catch Response: In this step, Automation Anywhere will deliver the results back to us.

- Set Response Variables: The information will populate into the rest of the workflow, so our systems can evaluate the results.

Now, a side note: for anyone who needs to dive further into the code, they can readily click through to dip into the details. The workflow is inherently low-code, masking the nitty-gritty programming from citizen developers. Like a matryoshka nesting doll: IT can remove the outer layers to drill down into the details, but other users can keep their focus on the bigger picture.

3. Triggers sent to loan analysts and customers

3. Triggers sent to loan analysts and customers

The Automation Anywhere RPA bot will then tell us what it uncovered in the investigation by answering the process question, was Peter “Found in OFAC?” In the foreground screen, you can watch the bot autonomously perform its duties.

If the bot does not find Peter on the OFAC list, he will automatically receive an email from PB Bank indicating that the application is looking good and moving forward. Congrats, Peter!

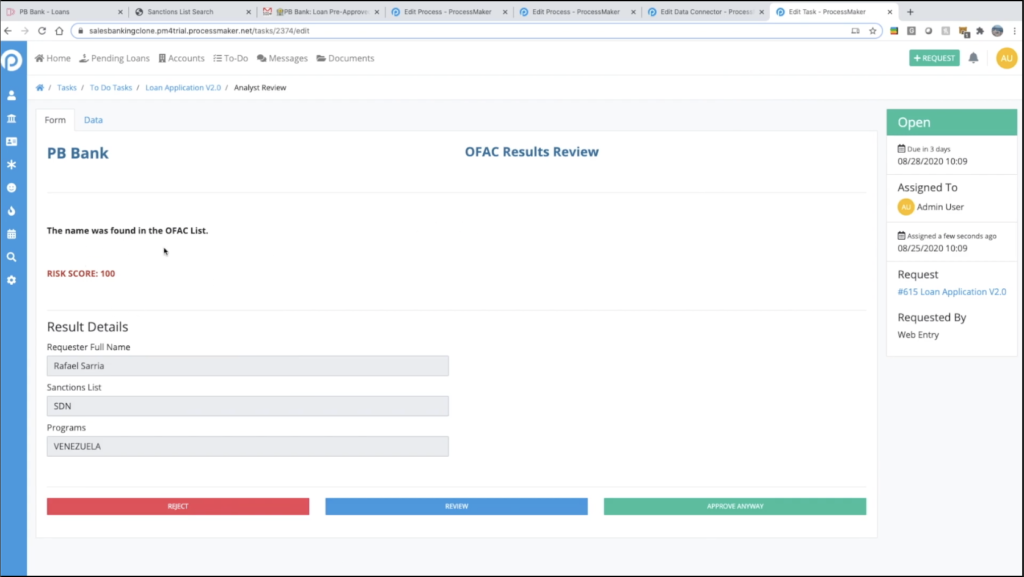

Now, say that a more nefarious character tried to apply for a loan, like this individual flagged by the U.S. Department of the Treasury for money laundering. Instead of sending the approval email, Automation Anywhere will trigger an alert in the appropriate loan officer’s ProcessMaker dashboard.

To the loan analyst’s dashboard, we go! You can see that our friendly automated bot has loaded everything into a ticket for us to review the applicant’s name and snippets from the OFAC record, like their risk score. From this window, the analyst can weigh what to do next—reject, review, or approve anyway—decisions that can kick off another batch of tasks.

To the loan analyst’s dashboard, we go! You can see that our friendly automated bot has loaded everything into a ticket for us to review the applicant’s name and snippets from the OFAC record, like their risk score. From this window, the analyst can weigh what to do next—reject, review, or approve anyway—decisions that can kick off another batch of tasks.

Voila! You’ve run through a prime example of how ProcessMaker and Automation Anywhere work together to infuse your workflows with the time-saving, efficiency-boosting power of RPA. Ready to get started? Schedule a quick demo now.