Banks and financial institutions face a constant challenge to stay profitable in an ever-changing market and increasing customer demands. Current trends in economic conditions and industry shifts are impacting banks and lenders, necessitating the need for process intelligence.

One of the effective ways to measure the profitability of banks is the cost-to-income ratio (CIR). This metric indicates the operating efficiency of a bank by comparing the costs it incurs to its income. It is pivotal for maintaining financial health and improving profitability.

Let’s break down this hot topic and look into strategies that can improve the cost-to-income ratio in banks.

Understanding the cost-to-income ratio

The cost-to-income ratio is a key financial measure in banking. It essentially compares the operating costs of a bank to its operating income. A lower CIR implies higher operational efficiency, which is an ideal scenario for banks. However, if the ratio rises, it indicates that costs are increasing at a higher rate than income, which could signal potential problems for the bank.

A simple summary of how cost-to-income is calculated

Here’s a more detailed breakdown of the elements involved:

- Operating expenses: These include all costs incurred by the bank in the course of its regular business operations. This could involve administrative costs, personnel salaries, rent, utilities, depreciation, amortization, and other operational expenses. It does not include extraordinary or one-time costs.

- Operating income: This is the income generated by the bank from its core business activities. It usually includes net interest income (the difference between the interest income generated from assets and the interest paid on liabilities) and non-interest income (like fees from services such as wealth management, payment services, etc.). Banks report their financial results for a given period on different timelines, which can impact the comparison of cost-to-income ratios.

To get the cost-to-income ratio, you divide the operating expenses by the operating income, and multiply the result by 100 to express it as a percentage. This gives you the proportion of the bank’s income that is being used to cover its operating expenses.

For instance, if a bank has operating expenses of $500,000 and an operating income of $1,000,000, the cost-to-income ratio would be (500,000 / 1,000,000) * 100 = 50%. This means that 50% of the bank’s income is being used to cover operating expenses, which implies that the bank has a relatively high operational efficiency.

Is there an ideal cost-to-income ratio for banks?

A well-managed cost-to-income ratio can contribute to the long-term success of a bank. It signifies the financial health of the institution and forms the basis for strategic financial planning.

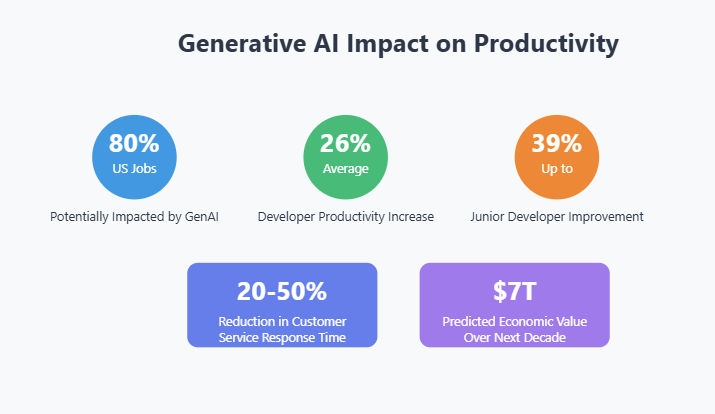

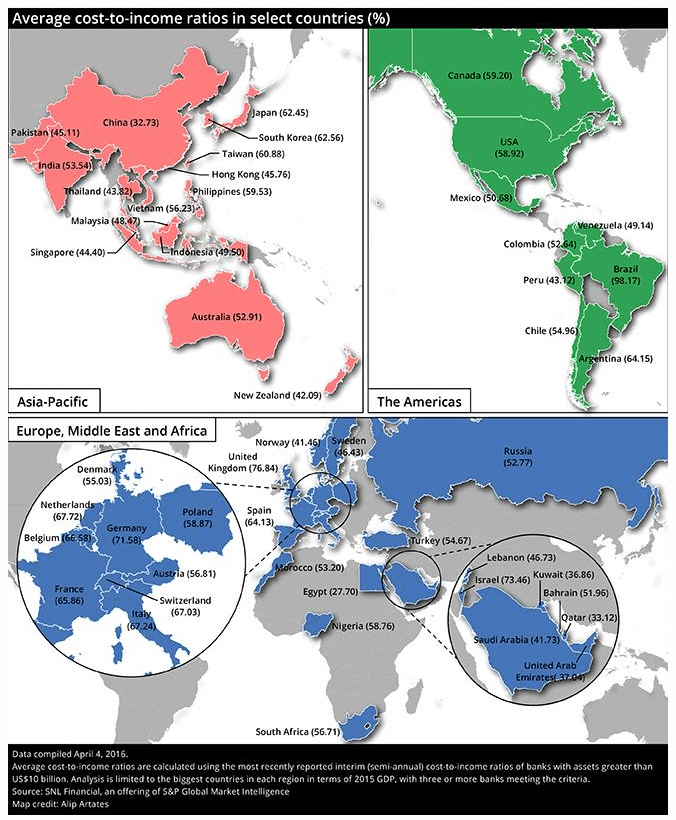

The ideal cost-to-income ratio for banks can vary based on the specific characteristics of the institution, including its business model, size, and geographical location. However, generally speaking, a lower CIR is seen as better since it signifies greater operational efficiency. Below you see cost-to-income ratios by S&P Global.

Average cost-to-income ratios by spglobal.com

For traditional retail banks, a cost-to-income ratio of around 50-60% is often seen as acceptable. This means that for every dollar of income generated, the bank spends between 50 to 60 cents on operational and administrative costs.

For more technologically advanced or digitally oriented banks, the cost-to-income ratio can be significantly lower, often in the range of 30-40%. This lower ratio can be attributed to the efficiencies gained from digital technologies, such as automation and streamlined processes, which can significantly reduce operational costs. Leveraging data to discover patterns and insights can lead to new operational efficiencies and significant cost savings.

While a lower CIR is generally desirable, it should not come at the expense of critical areas such as customer service, risk management, and regulatory compliance. Balancing efficiency and effectiveness is key to a healthy banking operation.

While there isn’t a universally ideal cost-to-income ratio for banks, aiming for a lower ratio while maintaining high standards of service and compliance is a good rule of thumb.

Strategies to improve the cost-to-income ratio

Staying ahead of current trends is crucial for banks to effectively implement strategies to improve their cost-to-income ratio.

The main approach to enhancing the cost-to-income ratio involves either increasing income or reducing costs. Often, a balanced combination of these two tactics is the most effective.

Increase non-interest income

Let’s start with the obvious way to improve profitability. Banks make money by providing and earning interest from loans. Marketing and attracting more customers is the direct way to increase income. In a competitive environment, banks need to balance the risks and rewards of offering more loans.

Non-interest income is another significant source of revenue for banks that help diversify their income streams and reduce dependency on interest-based earnings. Here are several strategies that banks can employ to improve non-interest income:

- Fees for services: Banks can charge fees for services like wire transfers, overdrafts, ATM usage, account maintenance, and late payments. However, they must be careful to maintain a balance so as not to alienate customers with excessive fees.

- Offer additional services: Banks can offer additional services like wealth management, asset management, insurance, or brokerage services. By providing these services, banks can earn commissions and fees that add to their non-interest income.

- Cross-selling and upselling: Banks can leverage their existing customer relationships to cross-sell or upsell other financial products or services. For example, a customer with a checking account may also be interested in a mortgage, credit card, or investment product.

- Strategic partnerships: Banks can form strategic partnerships with other businesses. For example, a bank could partner with a travel company to offer co-branded credit cards, or with a retailer to provide store-branded debit cards. These partnerships can generate fees and other non-interest income.

- Treasury operations: Banks can generate non-interest income through their treasury operations, such as foreign exchange trading, securities trading, and other financial market activities.

- Service bundling: By bundling services together, banks can offer ‘value-added’ packages to customers, often resulting in higher overall fees.

While these strategies can increase non-interest income, they should be executed while keeping in mind regulatory constraints and the bank’s long-term customer relationship strategy. Overemphasis on fee income could potentially lead to customer dissatisfaction and attrition, so a balanced approach is necessary.

Cost reduction strategies for banks

Discovering patterns and insights through data can lead to new operational efficiencies and significant cost savings.

Reducing costs is easier said than done in banking. Banks are complex organizations with many regulatory and customer-facing activities that involve highly skilled work and networked teams, workflows, and processes.

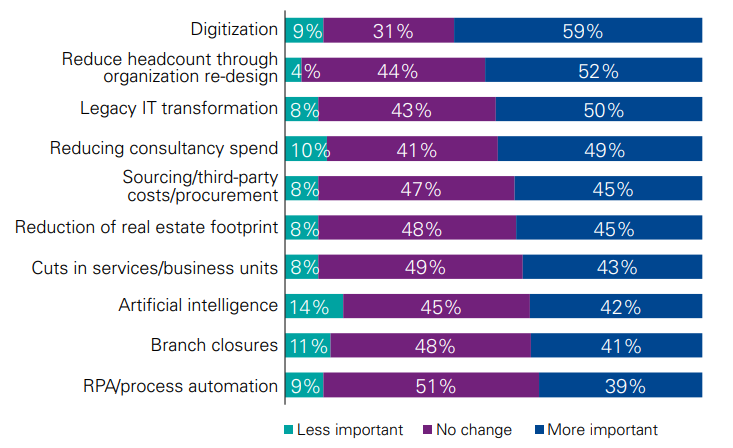

KPMG has identified a number of core cost-reduction strategies for banks.

Let’s highlight a few of the key cost reduction strategies highlighted within the research by KPMG.

Areas of cost reduction opportunities for banks identified by KPMG

Digitalize core processes

The adoption of new technology can help banks significantly reduce their operational costs. The natural benefit of digitalization is that banks replace inefficient work (such as loan applications filled out and reviewed by hand) with digitalized workflows that can be automated or streamlined to a significant extent.

Implementing banking software, automated processes, and digital platforms can enhance efficiency, reduce human error, and save on personnel costs.

Reduce headcount through organizational re-design

Banks can have significant front and back office workforces with various specialist roles and skills. Some of the common ways to reduce organizational headcount can include offshoring or near-shoring non-core work, and centralizing or removing duplicate work happening across different teams. KPMG estimates that over 50% of the non-interest costs for banks come from compensation or related employee costs.

Modernize legacy IT systems

Many banks rely on legacy IT systems that have built up considerable administration and maintenance costs over years (or even decades.) The technical debt of maintaining legacy systems contributes significantly both directly to IT costs and indirectly to the efficiency of work.

According to recent research by ProcessMaker, up to 50% of office work involves repetitive tasks, such as swivel chairing between different systems or manual data entry into spreadsheets or data systems.

Control 3rd party costs

The reduction of consultant spending or 3rd party costs is an obvious way to keep costs in control. Strict budgeting and cost control measures can help keep expenses in check.

This can include monitoring and controlling marketing and advertising costs, implementing cost-effective training programs, and renegotiating contracts with suppliers and vendors.

Streamline operations

Branch closures, reduction of real estate footprint, and cuts in services and business units are also common ways to streamline operations. By identifying and eliminating unprofitable resources, banks can improve efficiency and reduce costs.

Additional measures could involve simplifying reporting systems, automating routine tasks, or restructuring departments to improve workflow.

Leverage intelligent automation

Finally, the adoption of robotic process automation (RPA) or artificial intelligence brings new opportunities to automate some of the repetitive tasks or parts of workflows slowing down or adding costs to banking processes. It’s no surprise that banks and financial services have been some of the early and enthusiastic adopters of intelligence automation.

Using process intelligence to improve the cost-to-income ratio

One common thread in many of the cost reduction initiatives for banks is that they involve operational excellence initiatives or teams. As much of the work in banking involves knowledge-intensive work, initiatives that involve optimizing or automating processes can have a significant impact on the bottom line.

Getting traction on key initiatives requires a clear strategy, extremely tight focus, and clear communications. It also requires the right tools for operational cost transformation.

Process intelligence software like ProcessMaker PI is an increasingly popular tool for operational excellence leaders in banks and financial institutions. It combines the power of process mining and task mining in a way that ideally suits banking processes.

The core benefit of process intelligence is end-to-end visibility of your operational work and processes. In other words, it gives you transparency on how and where work gets done. Process transparency gives you an x-ray into the health of business operations and data-driven insights on how and where they can be improved.

ProcessMaker PI’s banking process intelligence is one option to consider as a solution specifically designed for the needs of banks and financial services.

Bottom line

Improving the cost-to-income ratio is a complex task that requires a multi-pronged strategy. By focusing on increasing income, implementing technology, streamlining operations, managing costs, and enforcing robust process improvement programs, banks can work towards improving their cost-to-income ratio and thereby their overall financial health and profitability. Staying ahead of current trends is crucial for banks to maintain profitability and improve their cost-to-income ratio.