Open the banking app on your phone, and one thing is clear: you can do just about anything quickly. Yet, slide over to the suite of corporate banking tools and things feel markedly different. Processes developed for corporate use are often slow, blocky, and more cumbersome to move through. Onboarding in corporate banking can take 90–120 days for these clients—an unforgivable timeframe in the digital realm.

Corporate customers are consumers themselves, and they increasingly expect the same user-friendly applications that they use in their personal lives to trickle down into their workday. Fortunately, the gap between personal technology and workplace technology is shrinking. Here’s how financial institutions leading the technology landscape are reshaping their digital onboarding experience for corporate clients.

What is digital onboarding in corporate banking?

Simply put, to digitally onboard clients, you need to shift your application experience from in-person to the internet. But, digital onboarding is more than adding an online form to your website that customers can fill out on their smartphones. It involves both the front-end and the back-end: an end-to-end strategy that touches every element of the onboarding process.

What are the most important characteristics of an effective digital onboarding experience?

Internally, every process in the onboarding mix should involve automated steps that reduce unnecessary human touchpoints to ultimately accelerate decision-making.

- A focus on the external customer experience, not your bank’s internal capabilities

- A self-service portal that allows customers to apply online and upload vital documentation

- Comprehensive, highly diligent KYC checks that don’t slow down processing time

- E-signature tools that reduce (or eliminate!) paper-based signoffs

- No unnecessary back-and-forth communication with customers

- The ability for computers to read, sort, and process attachments and other corporate data using technologies like machine learning and robotic process automation

Since it’s one of the first interactions a new customer has with your bank, it’s important to showcase how convenient, customer-focused, and well-oiled your operations are. A poor, time-consuming, or disorganized onboarding experience leaves a sour first impression that can be difficult to overcome.

Traditional onboarding vs. digital onboarding

The onboarding experience in banks involves four major workflows:

- Data Collection

- KYC Due Diligence and Screening

- Risk Rating

- Onboarding Decision

For banks that rely on traditional methods, each step is rife with paperwork.

- Incoming clients need to submit a laundry list of paper-based forms (often in-person at a branch!) and submit a slew of hard signatures.

- Existing online processes are far too clunky and require too many clicks, sending customers over to competitors that better value their time.

- Digging through the data is an armada of compliance employees, manually performing checks and collating the results.

- The superabundance of labor-intensive, done-by-hand processes is the foremost time drain preventing banks from serving a swift onboarding experience.

What makes onboarding toilsome and time-consuming are the qualities that make it ripe for digitalization. Many processes involved in onboarding for corporate clients include running through a customary checklist and verifying documents against a set of standards. Automated technologies are experts in this realm, making them a must-have in your digital onboarding arsenal.

What challenges do banks face when moving to a digital onboarding strategy?

Lassoed by legacy IT systems, it’s challenging for banks to introduce new technologies. And banking professionals are feeling the pressure—9 out of 10 rank the complex tangle of existing systems as their most significant obstacle to introducing digital onboarding initiatives at an effective pace.

Fortunately, outdated legacy interfaces are melting away.

Modern businesses enjoy user-friendly, low-code process management platforms like ProcessMaker. Even employees of the century-old New York City subway system navigate train delays using Slack. Snappy tools that are downright delightful to use are raising corporate expectations for the experiences that underpin banking. As a result, “enhancing the client experience” is a top strategic priority for 83% of corporate banking executives.

Here are the challenges banks are facing on their journey to digital:

- Outdated systems form a house of cards: Interactions are locked together, making it a challenge to change one aspect without bringing down the whole system. Often, they’re unshakably cemented into a single vendor’s offerings, making it almost impossible to implement apps from newer entrants.

- Limited transparency: It’s hard to pinpoint exactly where an application is within the overall process, identify what steps have been completed, and which ones remain.

- Scattered data: Information lives in spreadsheets, inboxes, and shared drives.

- Siloed systems struggle to communicate: This leads to redundant steps and processes that are blind to the others running through the organization.

By focusing on automation, banks can eliminate these obstacles and create an onboarding experience that nurtures lasting relationships.

How to digitize the four major workflows in digital onboarding

Let’s review the four main workflows that underpin digital onboarding and see how intelligent automation tools can help you build a more seamless, convenient, and enjoyable onboarding experience for your corporate clients.

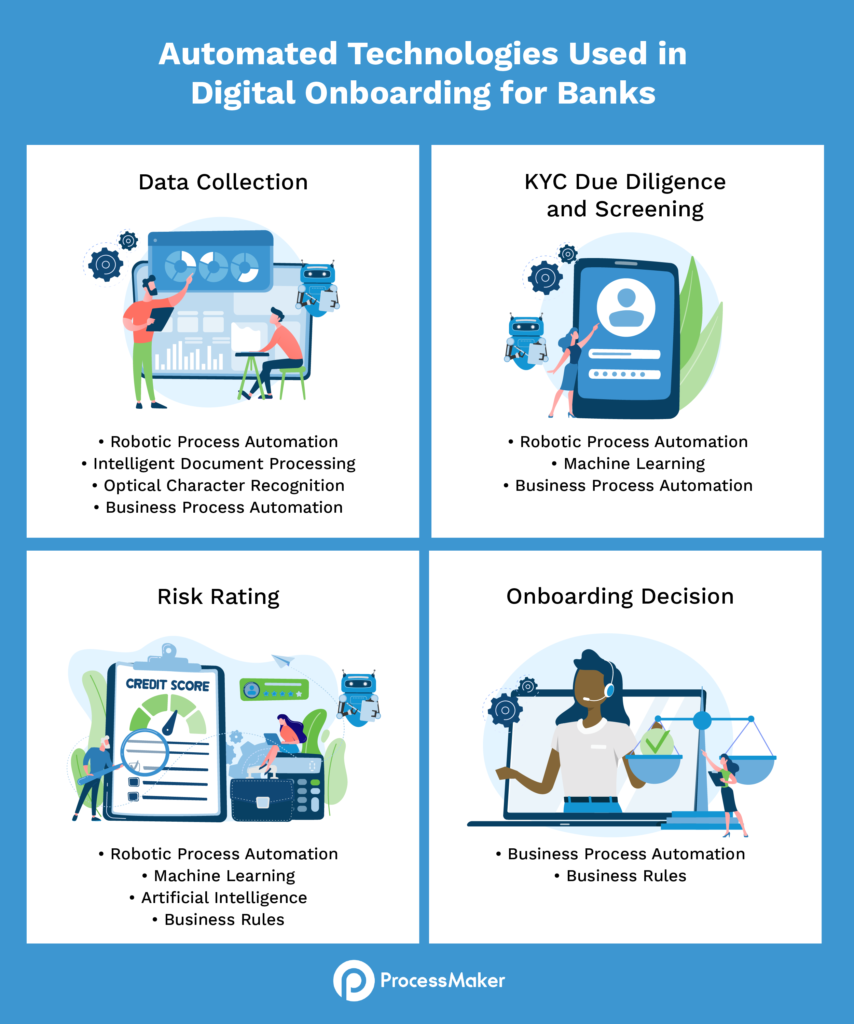

Automated Technologies Used in Digital Onboarding for Banks

Data collection

The challenges: These early collection and screening steps can take 6-14 weeks to complete. Why? For corporate clients, the data collection process includes far more than personal banking. Banking executives need to gather documents like articles of incorporation, business licenses, partnership agreements, and background intel on stakeholders and signatories.

Tracking the compilation of this information is key—a study by Thomson Reuters reveals that banks contact corporate applicants an average of eight times throughout the onboarding process. Frequently, the circle-back is to ask a client to resubmit a document they’ve already sent. Even more delays pile up when banks lacking digital onboarding processes require clients to deliver a document in person.

Through a digital onboarding lens: Intelligent technologies like robotic process automation and optical character recognition can be the “eyes” of your bank. This squadron of robots can read through information, even if it doesn’t fit into a structured template, like emails and online help chats.

Using Business Process Automation, you can create a digital checklist of every form the new customer must complete. Software robots can automatically review and confirm receipt of incoming documents and immediately pass the application to the next workflow once everything is in.

KYC Due Diligence and Screening

The challenges: Here’s where banks perform comprehensive checks on the dossier of data they’ve spent the last several weeks assembling. At this step, compliance professionals infuse further insights through Know-Your-Customer (KYC) and Anti-Money Laundering (AML) checks to build a clearer picture of a customer’s history and verify that they’re not known criminals.

The phase also includes several departments. In a nutshell, it’s easy for banks to lose track of an applicant’s status as it wanders through this myriad of steps. Despite the onslaught of paperwork involved in this phase, a surprising 26.2% of banks still manage this entire process manually.

Through a digital onboarding lens: Software bots can stand in for human workers, taking on assignments like copying and pasting data, populating forms with details written in attachments, and transferring files between systems. They can also log into government databases and third-party intel to scrape and gather further information.

Risk Rating

The challenges: Once all this information is checked and collated, banking executives assign the corporate applicant a risk rating. This dictates their approval status, what services they’re eligible to use, and what level of continuous monitoring they require. Doing this by hand is a time-consuming and costly process, commonly fraught with errors—humans incorrectly interpret AML checks 40–50% of the time, according to one expert.

Through a digital onboarding lens: Automated systems can assign risk ratings autonomously. Using business rules, you can “teach” systems to make decisions based on the same standards your employees use. Instruct software to downgrade applicants below a certain credit score or instantly boot those that appear on an anti-terrorism blacklist. Your rules engine can test KYC results against your risk appetite and approve or deny applications accordingly.

You can train systems to red flag applications that hit a snafu during KYC, alerting executives to take a closer look. Approved customers with higher risk ratings can be automatically enrolled in more frequent review processes. Those who pass with flying colors can instantly sail onto the next step.

Onboarding Decision

Challenges: A great deal of processes kick off in this phase—it doesn’t matter whether you’ve decided to approve or deny the customer. For applications that are a “no-go,” you need to send out information regarding your decision. For customers you approve, you’ll need to initiate another round of workflows like account creation, credit terms, and service activation.

Through a digital onboarding lens: Depending on the final decision, business process management handlers can automatically hand off the applicant to the next batch of steps. Plus, software can file away the contents of the application into digital storage, so you can maintain regulatory compliance with ease.

Onboarding is a data-heavy procedure that poses an obvious stumbling block for banks trying to serve a fast and efficient experience. Thanks to automation, you can engage software to do the heavy lifting, and reduce processing times from a meandering 90–120 days down to a swift few days.