The world that we live in is constantly evolving. Our mobile devices have become mini-communication hubs that seemingly power our interactions. These communication trends have infiltrated the business world, leaving organizations scrambling to find ways to new methods of customer communication.

The banking industry initially fell behind other industries in terms of digitizing the customer experience. Fortunately, that has begun to change as more and more banks prioritize providing exceptional customer experiences to gain an edge over competitors. Having made the transition, it is more important than ever that banks continuously monitor customer behavior and preferences; as well as technological innovations, to streamline the customer communication process.

Banks should begin exploring and incorporating these tips to improve bank customer communication to remain competitive.

10 Strategies to Improve Bank Customer Communication

1. Customer Communication Hubs

One of the most significant customer communication challenges that banks face is overcoming bottlenecks in their workflows. This is caused caused by omni-channel customer interactions. Communication hubs help banks to manage a large volume of customer interactions by serving as gateway and seamlessly diverting communications to the appropriate stakeholders.

Designing workflows in communication processes helps organizations to identify and plan for the flow of multi-channel customer communication through the organization. BPMS with form builder and advanced email functionality makes it easy to collect and manage information, as well as interact with banking customers.

2. Personalized Bank Customer Communication

Digital marketing is becoming increasingly personalized and focused on delivering relevant information to users. Marketing departments must collect and analyze customer data to gain important insights into customer needs and expectations. Using customer insight data, banks will need to deliver personalized and relevant messaging and content.

The common perception is that customers view personalized advertising and communications as annoying and/or intrusive. Yet, according to statistics, some 51% of customers expect that companies will anticipate their needs and make relevant suggestions. Moreover, 88% of marketers in the U.S. reported seeing improvements due to personalization. Personalization works and will play an increasingly important role in the future of the banking industry.

3. Segment Bank Customers Who Still Prefer Paper

Banks must strike a careful balance between digital and paper-based forms of communication. Going all digital on all channels risks alienating customer segments that still expect and desire paper-based communications. Thus, paper communications will continue to play an important role. The challenge that banks will face is finding ways to minimize the costs of serving these customer segments and managing customer communication across channels.

This is not to say that banks should not move away from manual paper-based processes. Rather, digitization is key to boosting efficiency, lowering costs, and maximizing profitability. For instance, automating the account opening process provides customers with a seamless experience that also benefits organizations by reducing time consuming processes like data collection, while boosting compliance.

4. Ensuring Customer Communication Compliance

Stakeholders throughout banking organizations will need to work together to streamline communication processes. For instance, digital regulatory communications are often created and managed using tools that are designed for marketing communications, like a CRM system. Compliance teams will need to work with marketing and IT teams to ensure compliance while simultaneously providing superior customer experiences.

5. Understand the Bank’s Customer Journey

Like personalized forms of customer communication, banks will need to collect and analyze data to gain insights into the complete customer journey. This requires an understanding of all interactions with customers at different points in the customer lifecycle. Banks will have to focus on making customer communication easier and more accessible.

The easiest way to understand the customer journey is to map out the process. Business process management software is a great tool to design customizable and simple process maps to highlight the customer journey.

6. Superior Customer Experience (CX)

An important aspect of the customer experience going forward is managing customer communications across all engagement touchpoints. Most of these engagements are driven by communication processes and technology. Automation technologies will play a larger role in banks’ ability to manage complex communication processes and provide superior customer experiences at each point of interaction.

7. Refocus to Customer Inbound Communications

Historically, the majority of bank customer communication has involved outbound-only communication processes. This is slowly changing, however. The ability to develop efficient processes to manage inbound customer communications will become more and more important in the coming years.

Banks will need to ensure that incoming information is routed to the appropriate stakeholders. They will need a way to automatically extract information to both collect and analyze data, as well as reduce the costs and errors associated with manual data entry processes. Business process management software that streamlines these inefficient banking processes provides organizations with industry leading automated solutions.

8. Manage Customer Feedback

In a world where banking customers can post damaging comments and reviews across a wide range of platforms, banks will need to take action, or close the loop with customers to mitigate reputational damage. Technological innovations like the ability to receive automatic notifications via web or mobile if a customer response indicates a negative experience, will help banks to respond in real-time.

Banks must also monitor and track feedback to ensure resolution, as well as gather data for both business process improvement and training purposes. These methods will not only reduce negative publicity but will play an integral role in improving the customer experience.

9. Gather Employee and Stakeholder Feedback

An essential component of business process improvement is gathering employee and stakeholder feedback. This provides organizations with invaluable insights into business processes from those that are most familiar with their inner workings. Banking employees are on the front lines of customer communication. Their responses and suggestions should be available to each stakeholder to facilitate improvement in customer communication processes.

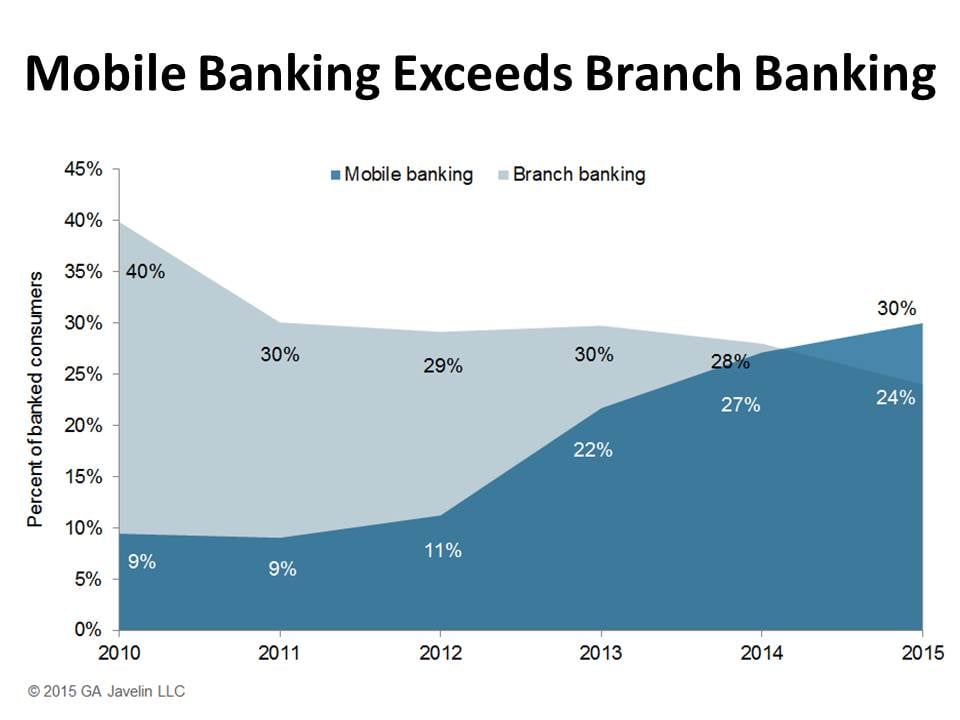

10. Mobile Banking is No Longer Optional

Approximately 8 out of 10 Americans use a smartphone while half of the adult population owns a tablet. Banking customers no longer view mobile banking as a nice to have feature. Mobile banking is now an essential service. This is especially true following the outbreak of the COVID-19 pandemic. Customers were already avoiding visits to physical branches, now they are more avoidant than ever.

Banking customers expect to handle most banking tasks without leaving the comfort of their homes. It used to be that banking customers wanted the convenience of checking their balance online or to deposit a check. Customers increasingly expect to communicate through chat or other mobile features in real-time. They also want cross-device functionality, like omni-channel account opening. If your banking organization is not already offering mobile banking with industry leading features, now is the time to get on board.

About ProcessMaker

ProcessMaker offers a low-code bank automation software solution and business process management solutions to help your organization lead the way in bank customer communication. Please contact ProcessMaker today to learn how ProcessMaker can help your organization to provide industry leading customer experiences. Schedule a 7 day free trial or download our whitepapers.